June has finished and marks the half way point of year – so how has it been in golf retail so far in 2017? Time for another market update!

In general things have been pretty good in June. The market was up 6.2% in value and both On and Off course retailers shared the gains. Year to date saw 12.14% growth for H1 versus 2016 – so June was a little down on the year to date trend.

We saw some mixed performances across the various product categories. On course saw growth in all areas – with clubs being slowest (up 2.8%) and Apparel being one of the hottest (up 9.1%). Off course in contrast saw strongest growth in consumables (up 21%) with a decline in Apparel (-5.2%).

So generally things were a bit off this month compared to the last few. Weather had an effect on this. June 2017 was the 5th warmest and 6th wettest sine 1910 – a funny old mix. This combination seems to have hit participation with on course ball volumes just up on last year by 0.6%. This compares with 11.4% year to date. To reinforce the fact Weather wear was up in units 4.4%.

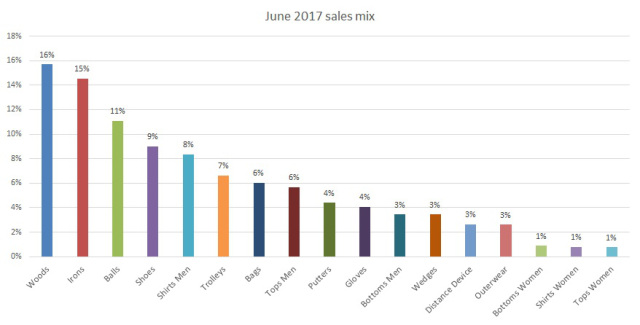

So what did golfers spend their money on? It was a pretty mixed bag!

Woods and Irons are still top of the pile – but less then previous months. In fact hardware accounts for 38% this month compared to 49% of 3 months ago.

Shirts are the first apparel category ranked 5th overall with 8% of sales. Apparel accounts for circa 23% overall. Other than that no real surprises.

So what are the top earning products so far in 2017?

Back by poplar demand – lets take a quick look at the products that are pulling the most cash through tills across the UK.

In 5th place – TaylorMade M2 17 Driver In 4th place – TaylorMade M2 17 Irons In 3rd place – Ping G irons In 2nd place – Callaway Epic Driver In 1st place – Titleist Pro V/XSo the ever popular Titleist Pro V series ball continues to dominate the total spend table.

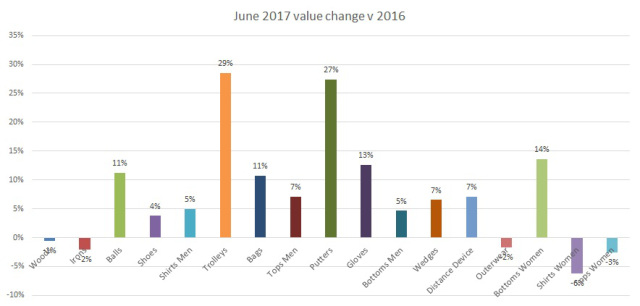

How are each of the categories fairing this month and the year to date?

Generally things are looking good. Growth is less than it has been but 12 of the categories are up and 5 are down. As the sales mix showed there has been a drop off in Irons and Woods. This is only small however so no alarm bells yet. Other categories have been fairing well with a good mix of growth throughout the store. Trolleys and Putters continue to sky rocket.

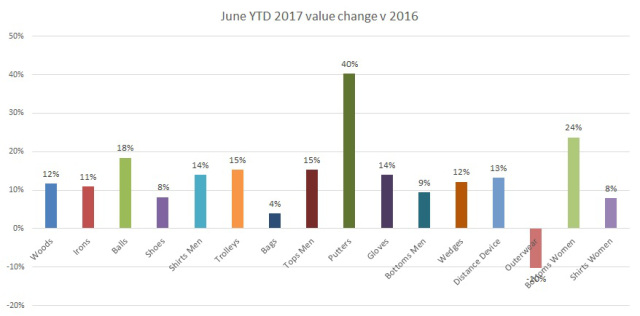

The story looks even better year to date.

All categories except Outerwear are up and for most its a double digit increase. Putters, Balls and Ladies Bottoms are the stars so far – Putters up an incredible 40% so far this year.

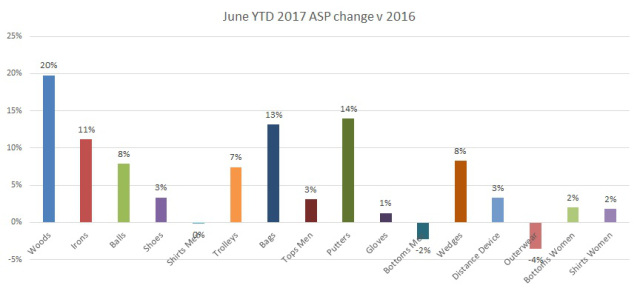

Values are up so is it ASP or Units that are driving the trend?

ASP’s have been up consistently all year and have delivered much of the value increase. Year to date the ASP’s changes are not consistent across all categories.

Hardware has seen huge increases with double digit growth in Woods, Irons and Putters, Bags, trolleys and wedges are not far behind. Is this genuine price increases or is this movement to higher price products – a good question and one I will answer shortly in another blog piece – and an article in Golf Retailing. The main point here is that while hardware is up a lot – apparel price changes have been limited and in fact we have seen drops in ASP for shirts, bottoms and outerwear.

So if prices are up units are down right?

Not entirely. We have seen some big drop offs in June for Woods and Irons. Bags, Tops wedges and ladies shirts also fell but the other categories are up. Looking at the YTD figures units have actually grown in 14 of the 17 categories. Woods, bags and outerwear are the only real looses all on circa 8% down. Irons are flat. On the plus side the second biggest ASP rise has come from Putters which has seen the largest unit increase YTD. So consumers are still buying in increasing numbers if they see some value or gains in the product.

Last of all – where are we going to end up?

Growth is slowing but remains positive. The way things are trending it looks like previous predictions of 8% – 10% total value growth is about right. This months Ping launch might have an effect – lets keep fingers crossed that we keep the momentum.

Share this: