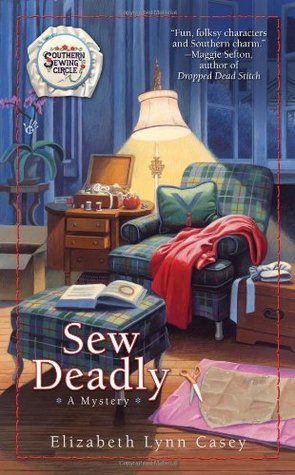

A rendering of the Avenue One project in Omaha.

by Dan Rafter

Busy. Active. Strong. Steady.

These are four of the words that consistently pop up when commercial real estate pros talk about Omaha and its commercial real estate market.

These words shouldn’t come as a surprise to anyone familiar with this market. Omaha has long been a model of steady growth when it comes to commercial sales, leases and development. This holds across all the major commercial sectors, office, retail, industrial, healthcare and, of course, multifamily.

Just listen to David Levy, a partner with Omaha law firm Baird Holm.

“The market seems strong today,” Levy said. “The commercial real estate market is busy. We continue to see a steady volume of deals. Our downtown area continues to be strong, and we are continuing to see activity in all sectors.”

That’s a good summary of the Omaha CRE market in 2017: steady, strong and full of momentum.

Tim Kerrigan, vice president of Investors Realty, agreed that Omaha’s commercial real estate market is an active one, saying that it is keeping brokers with his company busy.

“Our clients have a lot of oars in the water and plans in their heads,” Kerrigan said. “A lot of land is selling right now at high prices. Land that I have listed I am receiving a good number of inquiries on.”

All sectors active

Omaha’s industrial sector is especially strong today. Levy said that demand for industrial space is so high that it’s become difficult for users and developers to find land for new industrial facilities.

“It’s not always easy to find that 40-acre or 20-acre tract of land,” Levy said. “Others might be looking for something smaller, maybe a 5-acre site that is an industrial-appropriate one. That’s not easy to find, either.”

And while industrial is booming here, the other commercial sectors are more than holding their own. Levy pointed to the city’s retail market as an example.

As in all metropolitan areas, Omaha boasts pockets where retail activity is brisk and other pockets where it is more sluggish. But overall, the retail sector in Omaha is seeing more activity today.

Levy said that mixed-use districts are doing especially well in the city, the combination of retail, office and multifamily in a single development bringing in a wide range of shoppers, workers and residents.

“Mixed-use retail areas tend to have an advantage here,” Levy said. “They do really well if they are paired with places to eat and obtain personal services.”

One of Omaha’s strongest mixed-use areas is the Capital District in downtown Omaha, Levy said. The district, which developers are referring to as a new heart for downtown Omaha, will include a 333-room, full-service Marriott Hotel, 25,000 square feet of office space, 218 high-end apartments and 90,000 square feet of entertainment retail.

Then there’s the latest good news for Omaha: the Avenue One mixed-use development. This $1.2 billion development will be located south of 192nd Street and Dodge, and will bring even more new retail, office and residential offerings to the market.

“The approval of this project will be tremendous news for Omaha,” said Curt Hofer, chief executive officer of Jasper Stone Partners, one of the lead investors of Avenue One, in a written statement. “The jobs and economic activity resulting from this development will benefit the entire metro area. It is especially encouraging that Avenue One is now moving forward after acquiring the first piece of property over 13 years ago. We are eager to bring these benefits to the Omaha community.”

Jasper Stone Partners has hired Block Construction Services to oversee the project.

The Avenue One project will be one of the largest of its kind in Omaha, and is expected to have an annual economic impact of more than $1 billion according to research presented to the State of Nebraska for ranking state-directed highway improvement projects that can have the greatest positive economic impact.

Construction of the development is anticipated to create more than 8,500 jobs and the completed development is expected to generate more 8,900 permanent jobs.

Avenue One will transform about 200 acres of farm ground or an area that equals almost 50 city square blocks into new restaurants, shops, residences and offices across an interconnected, pedestrian-friendly area.

The project will feature office, retail, residential, hotel and civic spaces. With more than 7 acres of dedicated public plaza area, 26 acres of green space/ park and more than 6 miles of walking and biking trails Avenue One will be a walkable environment and feature a trail crossing and major investment in Youngman’s Park.

The project will consist of 1.3 million square feet of office and retail space and more than 2,000 residential units. Ground-breaking is set for mid to late 2017.

Kerrigan said that the office market in Omaha and its suburbs remains steady, especially for the right type of space.

“In terms of office space, if it’s good space and priced right, it will lease quickly,” he said.

Adam Marek, vice president with the Omaha office of Colliers International, said that office users who are looking for Class-A space in the Omaha market have limited options. And those Class-A users looking for large amounts of space might have to move into new construction, as the market for quality, Class-A office space remains tight, Marek said.

The same can be said of companies that have several locations in the market. If these companies want to consolidate their operations into one office facility, they might have little choice but to move into space built specifically for them.

“Our vacancy rate is low enough that for you to get what you want, it might have to be created for you,” Marek said. “If you are a company of a certain size or you have narrow geographic parameters in which you can relocate, you will be limited by that low vacancy rate.”

The tight office market is good news for Omaha, of course. It means that the city’s economy is strong and that plenty of companies want to do business from it.

But, as Marek points out, the tight office market is also the source of challenges for businesses.

“The market today requires a longer view,” Marek said. “If you are a Class-A office tenant and you want to relocate, it is might not be a six-month process. It might be a 24-month process. You might be moving into a building that doesn’t exist today.”

Busy times downtown

What’s behind the steady office market here, especially in the central areas of the city? Kerrigan points to the economic conditions of Omaha itself. The unemployment rate remains low here. At the same time, developers never overbuilt in the office market, keeping demand for available office space high.

“The stable market economics for sure help,” Kerrigan said. “But when it comes to office, there are a limited number of preferred locations. We are careful not to build too much product. There has been very limited spec construction in office. With a good economy, business is good. Add to that limited choices and cautious new construction, it lends itself to relatively short supply. And that lends itself to lower vacancy rates in the city.”

Commercial real estate professionals working the Omaha market say that the city’s downtown is especially strong today.

That’s largely because downtown, and the city’s Midtown district, have both become places where younger and older renters want to live to experience the conveniences of an urban lifestyle: These renters don’t want to spend their days driving. Instead, they want to walk to public transportation, shops, restaurants and entertainment.

Living in downtown or Midtown Omaha gives these renters that opportunity.

Levy points to Omaha’s Blackstone District as an example. This district, in downtown Omaha, is in the middle of a revitalization period, with smaller-scale commercial, retail and entertainment uses drawing in visitors and residents alike.

Of course, it’s not just downtown that is thriving when it comes to retail and office users. Kerrigan said that the Aksarben Village mixed-use development in Omaha’s Midtown area remains a strong draw for office users, too.

“We do have an interesting story in Omaha in that we have had great success with and have plenty of opportunities remaining in areas that are not in the traditional office markets,” Kerrigan said. “We have several alternative areas, like Aksarben Village, that are appealing to large office users. These large users might have to continue looking for these non-traditional office markets as space gets more difficult for them to find.”

Kerrigan pointed to the sprawling World Communications Park in northwest Omaha as an example. This park is on the edges of town, but it isn’t too far away from amenities. For instance, Sorensen Park Plaza, a 550,000-square-foot retail shopping mall is just one mile of the business park.

Of course, the downtown Omaha office market continues to attract plenty of users, and remains a key spot for those companies looking to attract Millennial workers.

Kerrigan said that downtown Omaha’s office market remains a varied one, one that can accommodate companies and employers of all sizes.

“The downtown office market has long supported large companies, our Fortune 500 and Fortune 1000 companies,” Kerrigan said. “It also supports big banks, law firms and other large companies. But it has also been a good home to smaller, unique companies. That continues to be the case. Employees are more than ever driving the office decisions that companies are making. And these employees often want to work and live in or near the downtown.”

The interior amenities of these office buildings matter to employers, of course. But Kerrigan said that for many companies, the amenities of the surrounding neighborhood are even more important.

Companies increasingly want to set up shop in areas in which their employees can quickly walk to restaurants, bars, shops and public transportation, he said.

“The amenities within the building are secondary to the amenities of the area or the neighborhood,” Kerrigan said. “Companies are looking for entertainment venues near their offices, everything from bars and restaurants to music halls and concert venues and stadiums. When you have those things, you will have all the complementary amenities that come along in terms of service businesses.”

Marek agreed that the most important amenity for officer users today is often the community surrounding their buildings. This doesn’t mean, though, that downtown Omaha has to be the location of choice for office users.

There are plenty of other office submarkets in the Omaha area that offer an urban feel in a suburban location. These areas provide the retail, restaurants and entertainment options that office tenants want, but in a location outside Omaha’s downtown, Marek said.

Marek points to Aksarben Village as an example.

“Technically, that development is not an urban environment,” Marek said. “But it is a city withink a city. It does feature the live/work/play feel. You can still go to work there, go to the movies there and eat at one of the restaurants, all without having to leave the development.”

Omaha’s retail market faces different challenges. Marek said that those retailers who are doing well today will continue to do well, not just in Omaha but across the country. Those retailers who are struggling will continue to downsize. Retailers such as Sears and Kmart are examples of retailers that will probably continue closing locations throughout 2017.

Marek said that in Omaha much of the space that larger retailers have abandoned has either been filled already or in the process of getting filled.

“There has been some right-sizing in the retail market,” Marek said. “The effort will continue to be to backfill and fill in those spaces that have been left empty. Most of those retail spaces that have closed have been backfilled or repurposed.”

More good times ahead?

Levy says that he expects the future to remain bright for Omaha. That’s because the city offers plenty to attract both residents and businesses, he said.

“Land costs relative to other big cities in the Midwest are attractive,” Levy said. “We have a strong and educated workforce. The cost of living is lower than in many places in the Midwest, and certainly lower than on the coasts. Our municipal regulatory process when it comes to land use is easily navigable. All of those things make Omaha an attractive place to invest and do business in.”

This doesn’t mean that Omaha doesn’t face its own challenges. Levy said that public transportation remains a hurdle here. There simply aren’t enough public transportation options for residents in the city or its suburbs.

“We continue to lack and be behind some of our peer competitor cities when it comes to public transportation,” Levy said.

Levy pointed to Kansas City with its recently opened streetcar line as an example of a municipality that has invested more in public transportation than has Omaha.

City officials and Metro Transit Omaha are working together on a possible bus rapid transit line along the city’s main east-west artery, Dodge Street. Levy said there is also growing support for a streetcar line in Omaha, much like the ones operating now in Cincinnati and Kansas City.

“That project has been in the planning phases for a long time,” Levy said. “But the support from the business community and public sector is growing stronger.”

Another challenge? TD Ameritrade Park is a hit during the College World Series, which the park hosts. It is also home to the University of Creighton’s baseball teams.

But much of the year, the park sits empty. Ideally, the Omaha Storm Chases minor league baseball team would play its games in the park, too, keeping it busier. But the Storm Chasers play in their own park in suburban Papillion.

Advertisements Share this:- Share