What a time its been for Easyjet since the 16th. Having taken a battering on the 16th May and dropping over 6% to 1215gpx the share price and risen every day since to sit at 1378gpx today, not far off my revised target price.

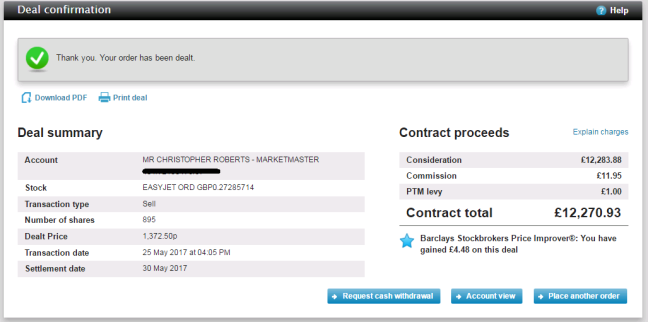

Despite my target price not having yet been reached, I have today sold at 1372gpx, netting 24.5% on my original investment.

Would I feel annoyed if the bull run continues and my target price is surpassed, most likely. However having been greedy in the past and suffered for it I now aim to cash in when I reach 20-30% increases. At the end of the day I can always buy back if the share dips, or simply look out for new opportunities.

Speaking of opportunity, I also sold my recent investment in GSK, taking a small profit of around £100.00. The share price since then has risen and decreased back down to my selling price, whilst my alternative investments of BT (BT.A) and TalkTalk (TLK) have increased slightly. I intend to put together research notes on both BT and TalkTalk over the next week looking at their case as recovery stocks. GSK isn’t going anywhere as a high income investment – I just need to time it right.

Portfolio value is now at £27,800 – almost 25% up in 9 months, showing that the strategy of generally investing in high yield shares and recovery plays is working.

Advertisements Share this: