To start off, I don’t want to be “one of those people”– you know, the ones who read self-help books and tell you how it has absolutely “saved [their] lives.”

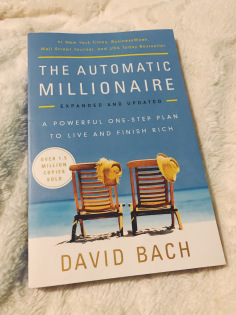

BUT: I actually did receive– and randomly– sometime last week, a self-help book offering some pretty practical advice. Before I go into details, I would like to note that the randomness of me receiving this book last week, is too messy to not share. I received this book on a morning in which I was highly paranoid (as you can see to the right). But it turns out, a great friend of mine sent it to me, without me knowing! Which is a much better alternative than the obvious case of identity theft I thought was actually occurring.

Anyway, the title of the book is The Automatic Millionaire, and it is written by a man named David Bach. The one that I received is the expanded and updated 2016 version. It is a highly acclaimed book, whose credentials speak for itself, but if you don’t believe me, a quick Google search will let you know what I am talking about.

One of the things that I liked about this book was that I was already doing much of what it advocated– and I’m not a millionaire. Hence, the ‘not so’ automatic nod in the title of my posting. For instance, I already:

- Use apps like Mint and Acorns to save money, keep track of expenses and bills. I should also note that I feel that this specific suggestion would only be available in the newer version vs the original 2003/4 version.

- I already donate regularly to charities and causes of my choosing, in really small amounts.

- I have all of my regular bills on automatic payment schedules: phone, car, internet, rent, and Netflix.

- I have my credit card monthly minimum payments also on an auto pay schedule.

However, I also learned quite a bit of new things that I can also do, to improve my financial standing:

- I can put two hours (he recommends one) of my bi-weekly paycheck into a IRA or similar pretax [retirement] account. Since I am quite young, by the time I retire, the gains in this account should be quite nice. If you have a 401 (k) you should also look into it and see what is going on. This will only benefit you.

- Open an online emergency savings account, which automatically deducts 5% of your paycheck, for emergencies.

- Open a dream account— which saves up for hopeful things like a new car, house, travel, etc.– which also automatically deducts a portion of your paycheck to save for things that you want to do.

Overall, I feel that these financial tips are are important to share with you all– especially to my fellow millennials. This being that today, most financial advice is not given in a non-demeaning way. I am thankful to have received this book and to have gotten small financial literacy tips throughout the years. However, I do wish that financial literacy was taught to my generation in high school and college, since most of us are not inheriting a vibrant economy. That being said, there are some opportunities, like this savings route– which may especially be useful for people who are not business savvy or internet savvy enough to be a successful entrepreneur or innovator in today’s climate.

Sadly, the downside to today’s (economic) climate is that innovation has gone down, while entrepreneurship has gone up. Increased entrepreneurship for us millennials however, has mostly been to substitute wages, due to wage stagnation. 86% of my income goes towards automatically paying bills listed above. Not taking food or groceries into consideration. So my savings are quite small, but savings do add up– and apps that gain better interest than banks, ensure that you see the results.

Do you do any of the things mentioned in Bach’s book? Are you planning on doing any of these things? If so, let me know…and if you do decide to sign up for an Acorns account (or alternatively a Stash account) let me know so that I can share my code with you, so that we can both get a free $5!

Sincerely, Tawm

Advertisements Share this: