This post is on 1/16/18, Tuesday afternoon at 12:00pm. I was out of town last week for work and then with family over the weekend and have been catching up since I got back Sunday night.

I am updating a few goals. I am adding $3000 to the account and keeping the same routine and plan.

Updated 2018 Goals:

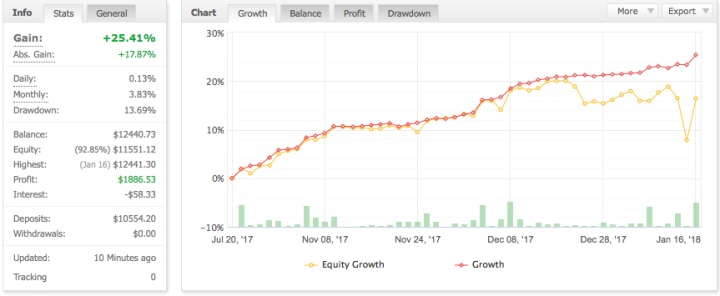

As of 12:00 pm, my current stats are:

Total Deposited: $10,554.20.

Balance: $12,440.73

Gain/Loss: 25.41% = +3.7% from last week.

Equity: $11,551.12. ***I will comment on this below***

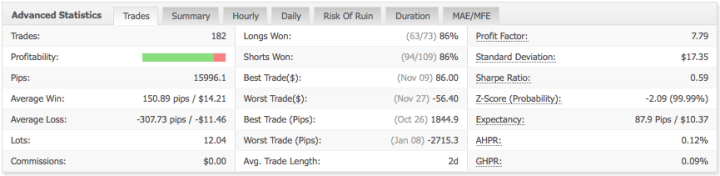

Open Trades: 17 – My original NZD/JPY, AUD/USD, and USD/ZAR trades from Christmas and New Years weeks are still agonizingly open.

Drawdown: 13.69% (Notice the deep yellow line dip on the chart below).

Transparency:

***This section is dedicated to me being as absolutely transparent with you as I can. I want anyone who reads this to understand what I am thinking, doing, and how I am measuring my success/failure at trading Forex.***

- Drawdown – So my drawdown has gotten away from me. I am very disappointed with myself for this. I know better. I am capping it at 15% ($1,373.70).

- Drawdown is how much your open trades go against you. You can choose the % that you are comfortable allowing. The way to control this is through tight management of your open positions, or very specific stop loss orders in place. The stop loss order will close your trade if a loss hits a point that you are no longer comfortable with it open.

- I have a problem with closing loosing trades. I know that I must enact stop losses the moment I open a trade. If I don’t, then the trade can become a loss that I don’t want to close. I am then tempted to open additional trades to the same pair.

- I have 17 trades open, 11 of which are going on a few weeks. 3 of them are in drawdown of more then $100 each.

- I have increased my account size. This gives me a little more room with drawdown, but also requires greater gains per trade to increase gain %.

- I am working on a excel spreadsheet that will be my money management system with the increased account size. I will post when it is complete.

- Goal for now is “hitting lots of singles” – $14 per winning trade (my current average) is 29 wins. My current win % is 86%. This will decrease a little with some tighter stops, but if I am taking 35 trades a month or about 9 a week, I don’t have to hit any home runs and risk to much.

- This is the true advantage of Myfxbook.com – it gives you lots of stats and insight into your trading and abilities.

- And lastly, I made another $410 trading Litecoin on Coinbase.com. Total gain up to $4400 roughly after all fees etc.

Thanks for reading,

Redlined 2

Advertisements Share this: