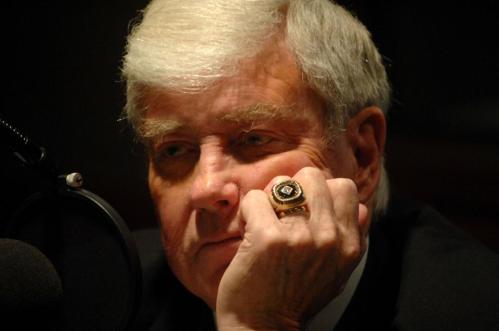

Jack Kemp appears on The Leonard Lopate Show on April 25, 2007 in New York City. (Photo by Brad Barket /Getty Images)

Jack Kemp appears on The Leonard Lopate Show on April 25, 2007 in New York City. (Photo by Brad Barket /Getty Images)

Today at Forbes.com Ralph Benko has a nice recollection of Jack Kemp and how tax rate cuts came about.

Excerpt:

Kemp was a multiple All Star and the leader of a team — the Buffalo Bills — which he led to two consecutive AFL championships. Jack Kemp lived for high achievement. He was not cautious to protect the moderate glory of elective office.

The foundational document of Supply-Side Economics, preceding Jude’s 1978 book The Way The World Works — which, back around 1980 when I was a provincial country lawyer, converted me to the Supply-Side — was Wanniski’s The Mundell-Laffer Hypothesis–a new way of looking at the world, published in the Spring 1975 issue of The Public Interest. In essence (pp. 37-38) it held:

In the Mundell-Laffer scheme of things, a common currency is not a utopian fantasy; it has been around before. For decades prior to World War I, the world had a simulated common currency as national currencies were tied to the pound sterling and the pound was fixed to gold. In the years after Bretton Woods (1944) until about 1967, or even 1971, the world had a simulated common currency bound to the dollar. The system was flawed, but still enormously successful.

The later-famous “Laffer Curve,” not yet denominated as such, was but a footnote on page 49. This fountainhead article was about good monetary policy (and, in particular, the gold standard).

Of course, in the event the tax rate cuts propounded by Kemp took political center stage while the core value proposition of Supply-Side economics, a high integrity dollar policy, got relegated to the Fed.

Advertisements Share this: