By: Leandra Lederman

By: Leandra Lederman

Back in December 2011, I received a targeted mailing. It was the postcard below, which I received at the office. T hus far, I haven’t found a Maurer colleague or tax friend who received this mailing. Some marketer apparently did his or her homework and identified me as someone with an interest in both tax and chick lit! I don’t get to read novels very often anymore, but this looked like exactly the kind of book I would enjoy. I even acted on the sticker on the reverse of the postcard, which said “A book makes a great holiday gift!” “Death, Taxes, and a French Manicure” was a great start to the Christmas list request I had recently received.

hus far, I haven’t found a Maurer colleague or tax friend who received this mailing. Some marketer apparently did his or her homework and identified me as someone with an interest in both tax and chick lit! I don’t get to read novels very often anymore, but this looked like exactly the kind of book I would enjoy. I even acted on the sticker on the reverse of the postcard, which said “A book makes a great holiday gift!” “Death, Taxes, and a French Manicure” was a great start to the Christmas list request I had recently received.

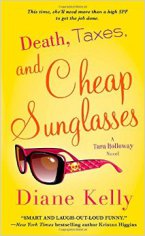

I received the book for Christmas and got hooked on the series. I’ve gotten through Book 10 so far. They’re a lot of fun. It never occurred to me to blog about them, though, until I read the first page of “Death, Taxes, and Cheap Sunglasses” while on a plane, and saw a link with tax issues I frequently write about. The opening paragraph reads:

“I slid my gun into my purse, grabbed my briefcase, and headed out to my car. Yep, tax season was in full swing once again, honest people scrambling to round up their receipts, hoping for a refund or at least to break even. As a taxpayer myself, I felt for them. But as far as tax cheats were concerned, I had no sympathy. The most recent annual report indicated that American individuals and corporations had underpaid their taxes by $450 billion. Not exactly chump change. That’s where I came in.”

I had just presented my latest tax compliance article, “Does Enforcement Crowd Out Voluntary Tax Compliance?” and here were tax gap figures showing up in a novel! “Death, Taxes, and Cheap Sunglasses” was published in 2015, when the annual federal tax gap was in fact estimated at $450 billion. (The updated tax gap figures, released in April 2016, and which I blogged about previously, are available here.)

Of course, the novel simplifies somewhat, calling the IRS’s periodic release on the tax gap an “annual report” and referring to taxes that are “underpaid,” while the Tax Gap Map (even the one available in 2015) distinguishes among nonfiling, underreporting, and underpayment. But I suspect that this is just simplification for a lay audience. The novel’s author, Diane Kelly, is no tax novice. She is described on her website as follows: “A former tax advisor, Diane Kelly inadvertently worked with white-collar criminals. Lest she end up in an orange jumpsuit, Diane decided self-employment would be a good idea.” This site adds: “A CPA/tax attorney, Diane spent several years at an international accounting firm, where she had the pleasure of working with a partner later convicted of tax shelter fraud. She also served a stint as an Assistant Attorney General for the State of Texas under an AG who pled guilty to criminal charges related to the tobacco company lawsuits.”

The heroine of this “romantic mystery series” is CPA Tara Holloway, who’s described as “kicking ass, taking social security numbers, and keeping the world safe for honest taxpayers.” She’s a Special Agent with the IRS’s Criminal Investigation Division who is also a crack shot, though she often improvises other weapons. The back of “Death, Taxes, and Cheap Sunglasses” quotes author Gemma Halliday as stating “Tara Holloway is the IRS’s answer to Stephanie Plum—smart, sassy, and so much fun.”

As the quote above from the first page of “Death, Taxes, and Cheap Sunglasses” may suggest, Diane Kelly takes a few liberties with what Tara can get away with. The acknowledgments in “Death, Taxes, and Peach Sangria” include the following statement: “To the IRS special agents, thank you for sharing your fascinating world with me and for all you do on behalf of honest taxpayers. Please forgive Tara for being such a naughty agent and breaking the rules.”

So, Tara’s not perfect, but the stories are fun and engrossing. They’re also full of interesting coworkers and other characters. “Death, Taxes, and Cheap Sunglasses” starts with Tara’s boyfriend, Nick, who is also an IRS Special Agent, being sent to Mexico to infiltrate a drug cartel after the arrest of El Chapo. Tara stays behind in Texas, investigating both an alleged animal sanctuary and an art museum suspected of being a sham used to shift income among family members. I won’t include any spoilers, but I will say that Nick can only check in sporadically from his undercover assignment, and we can count on Tara to save the day.

Spring Break is coming up, so, if you’re looking for a beach read, this is a great time to get ahold of the Death & Taxes series. I definitely recommend starting the series with the first book, “Death, Taxes, and a French Manicure,” because each book picks up at the phase in Tara’s life where the previous one left off. It’s available in both paperback and ebook form. There are also a couple of novellas available only in ebook form. I’ve skipped those so far, and that did not seem to interrupt the flow of the story. I’m planning to finally read those over the Break. Then all I’ll have have left of the books in this series to date is “Death, Taxes, and Sweet Potato Fries,” which apparently has another cross-border plot, as well as someone issuing bogus 1099 Forms!

Share this: