Published July 28, 2017

We found Josh Brown’s thoughts on the current market interesting. It could be extrapolated to be a comment on investing much of the time.

The negatives:

The US stock market is now selling for close to a record high valuation. Volatility for the S&P 500 is currently registering record low readings. Brilliant hedge fund managers like David Einhorn are ringing the alarm bells over the worship of growth stocks without earnings. Warren Buffett’s Berkshire Hathaway is sitting on a $90 billion cash hoard, struggling to find reasonably valued assets to invest it in. Bonds are no bargain given today’s yields vs inflation, and that’s assuming rates are just steady – if they rise more quickly than expected, there will be some pain.

The positives:

Cash is abundant, the economy is steadily improving, overseas there are signs of global economic recovery, the Fed is taking its time to normalize rates, commodity prices are presenting a goldilocks scenario for consumers, US corporate earnings growth has resumed, the labor market is the healthiest its been in a decade (this morning, unemployment fell to the lowest reading we’ve seen since May 2007). Small business confidence is soaring, because business owners love Trump’s can-do attitude and the prospect of lower taxes.

This is the push-and-pull plateau at which we currently find ourselves. There is plenty of good news, but securities prices are currently reflecting a lot of it (all of it?).

So what do you do?

Here are your five choices:

1. Ignore the negatives, buy and hold.

Sounds simple. It’s been working for a long time now. Everyone else is doing it. Buy the Vanguard 500, pay one or two basis points and just commit to riding it out like everybody else is now saying they’re going to do. In less than 10 years the investor class mindset has gone from “Buy and Hold is Dead” to “Buy and Hold is the only answer.” Which is true? Maybe dollar-cost averaging into a low-cost asset allocation, with periodic rebalancing, is the happy medium between the two.

2. Get out and go to cash.

If Buffett is building a $90 billion ark – despite the fact that he’s not claiming to see a flood coming – shouldn’t you be, proportionately, doing the same thing? But then the question is how much cash? What makes sense given each of our individual situations? Is it a dollar figure? A percentage? And how will we know when to deploy it? As my partner Barry explains, valuation is not going to give us the “all clear” to start buying again: “Fair value is a theoretical point that stocks careen past on their way to becoming wildly expensive or extremely cheap; it isn’t the point where equities gently come to rest.”

3. Diversify away from US stocks into other asset classes.

Sure, if US stocks are overvalued, then perhaps international stocks are a better bet. They’re cheaper. But! Historically, we’ve learned that a market event here can easily become a market event overseas. It’s one global market now. Cap rates and valuation on real estate are also flashing warning signs. Bonds are not what you would traditionally call cheap. Do we think the art market and the world of collectibles are going to hold up any better in a market swoon than they have in the past? Doubtful.

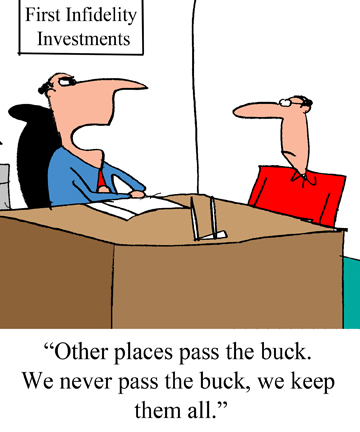

4. Bet against the market or hedge with short positions.

How much are you willing to spend in order to hedge your portfolio? Because insurance has a cost. Most options bets expire worthless. They also drive people crazy. I’ve seen people get mad when their protective call-selling or put-buying turns out to have been a waste of money – it’s almost as if they wanted the portfolio they were protecting to get killed, just to have the satisfaction of watching their hedges pay off. Insane, right? We are remarkably insane as a species, doubly so when it comes to money or sex. Is it worth paying someone 2 and 20 to do the protecting for you? Or just lower the risk profile of your asset mix instead? Can they actually do what they’re promising to begin with? How many hedge funds are actually in the business of hedging, as opposed to making concentrated bets?

5. Adopt a tactical asset management approach.

There are times when it pays to be more heavily invested and times where it pays to lighten up. Not all market environments are equally rewarding for long-only investors. But these times can only be clearly seen on a backward-looking performance chart. But are there present conditions that can be observed, like valuation or volatility, market internals or interest rate spreads, sentiment or fund manager positioning, that may provide clues about which regime we’re currently in?

The data is fairly decisive – US stocks selling at a high cyclically adjusted price earnings (CAPE) ratio do not historically offer the same upside on a forward basis that stocks selling at a low CAPE do. The current CAPE is at an extremely high level, as you can see in Jake’s graphic below (via MarketWatch), which does not augur well for the next 10 years in terms of average annual returns.

But this tells us nothing about the next one year, two years, three years, etc. In 1995, stocks rallied hard – from an already high valuation – over the next five years, with double digit returns annually for those who stayed the course: 1995 = 34 percent; 1996 = 20 percent; 1997 = 31 percent; 1998 = 27 percent; and 1999 = 20 percent.

This could happen again. Anything can. Are you willing to forego the potential for this sort of thing entirely because of a backward-looking price-earnings ratio that tells us nothing about the future? Will your financial plan allow for you to miss something like that and still reach your long-term objectives?

Again, this is hard.

Ignore everything and stay the course? Sell it all and wait for…something? Buy other things besides US stocks? Use hedging or short-selling? Get tactical?

You have to choose something. Even passivity is a choice, even if it is a default choice.

Nobody said outpacing inflation with your saved assets would be a walk in the park. The good news is, you don’t have to do this by yourself. Here at TimingCube, we have boiled investing in stocks down to a simply BUY or SELL decision. We put the data into our models and let them spit out the answer – an answer that has served us very well over many years and many different market environments. If you need help with your investing beyond just following our signals, contact our friends at MarketTrend Advisors. They are experts in our strategies and investing in general, happen to be very friendly, and helpful to boot.

Market UpdateGood earnings from companies as diverse as Black & Decker (SWK) and Halliburton (HAL) failed to overcome a cautious tone Monday that left stocks mixed while tech stocks continued their recent recovery to new highs. A slew of good earnings paraded through Tuesday with Caterpillar (CAT), McDonalds (MCD), DuPont (DD), and United Tech (UTX) all beating estimates to push the Dow Industrials Average up +0.4%. The Dow followed through on its good work Wednesday with component Boeing (BA) vaulting almost +10% on a strong earnings report while AT&T added +5% on good news. Stocks began Thursday once more pushing higher with Facebook (FB) being the earnings star that day. However, the wheels came off in the afternoon with the Nasdaq tumbling -1% at its worst and the high-flying tech stocks encountering some selling pressure. Friday began the same way with tech stocks continuing their slide before reversing to a mixed overall market posture.

For the week, the high-flying Nasdaq (QQQ) was flat at -0.19% while the S&P (SPY) closed flat at 0.01%. The smallcap Russell 2000 (IWM) dipped -0.41%.

Warm wishes and until next week.

Share this: