Download links for: The Real Crash: America's Coming Bankruptcy---How to Save Yourself and Your Country

Reviews (see all)

Write review

Interesting economic overview of the possible near future and it's causes.

As usual, Peter Schiff is spot on and highly entertaining. A must read.

scary stuff, don't agree with everything but a lot makes sense.

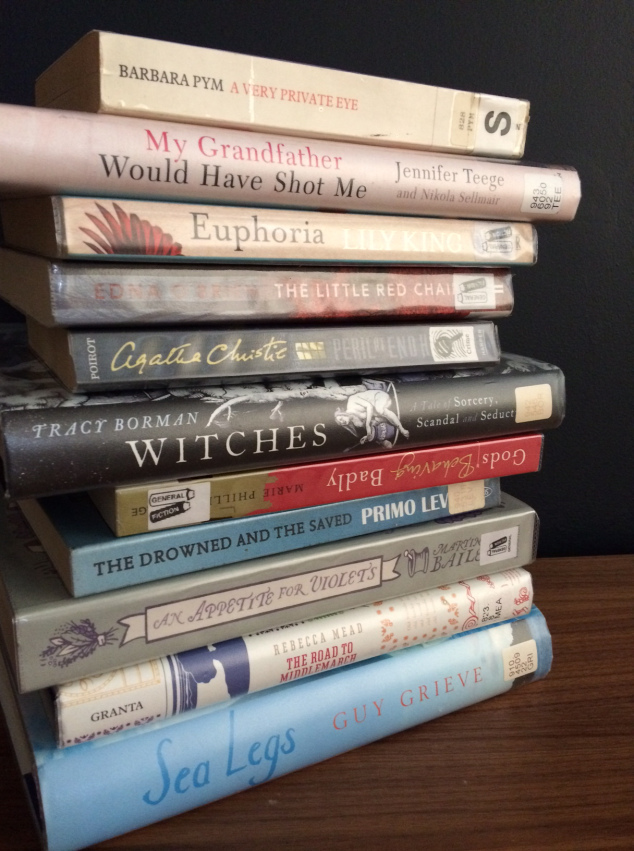

Other books by Nonfiction

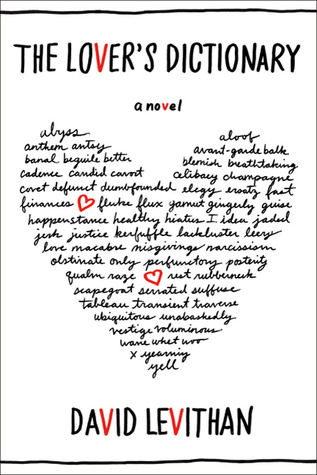

Other books by Peter D. Schiff

Related articles