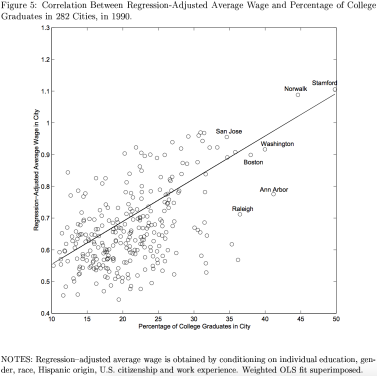

Enrico Moretti and other economists discussing spatial and urban economics have documented in the United States a divergence in earnings based on location. Hubs where there exists a great concentration of high skilled workers tend to be areas where all residents have high earnings relative to other regions.

This comes from the following two papers by Moretti: 2013 (with Thulin) and 2003. With this we know that high skilled labour in small cities transfers to these hubs. And married couples with high investments in human capital match up with each other and with high education hubs (Silicon Valley, Seattle, Los Angeles, Boston, etc).

It then seems important in the United States if this self-sorting has any consequences on the political objectives of cities and their citizens. The recommendations Moretti makes is increased investment in education. Competition for headquarters of a large internet firm or medical research company will result in outcomes that don’t benefit the residents.

It then seems important in the United States if this self-sorting has any consequences on the political objectives of cities and their citizens. The recommendations Moretti makes is increased investment in education. Competition for headquarters of a large internet firm or medical research company will result in outcomes that don’t benefit the residents.

Taking this one more step (maybe a step too far) we may find the voting results of residents different as the self-sorting takes place. If the country as a whole needs greater investment in education in “knowledge” sector the voting system may limit this. The electoral college will give the rural and low density populations a disproportionate voice. As these actors attempt to protect their fortunes, they’ll election politicians who’ll save their local industries. They’ll do so with protectionist policies, subsidies, tax breaks and so on. The point is the government’s budget is constrained, it can not give rural America tax breaks for their manufacturing jobs and institute a dramatic investment in high level education. But the voting system favors the local population in low density areas, so they’ll keep voting for immediate solutions that don’t harm their welfare in the near term.

That’s not to say that proportional representation is correct form of governance but rather that the prior uncertainty (belief) in a human capital investment by rural residents is very high. This is due to the natural uncertainty anyone can have in an investment and lack of smoothing by agents (contrary to theory).

I have discussed at length on this blog last year the ways in which students don’t anticipate debt burden in a manner similar to the consumption cycle in labour economics. I think an assumption can be made for the rural voters (or voters in general) when they vote in investments in education. However, we further assume that this isn’t shown by compensating for the investment with higher taxes or certain reforms but rather compensated by lack of belief in the investment itself.

How can we model such actors? We can give them imperfect memory or a bias to their immediate welfare changes. So, a off-shoring jobs to a third world country pains them much more than the change 10 years from said off-shore in earnings after re-training. Their posterior beliefs will change but that’ll take time and experience. Again, expectations in returns to education I have discussed previously are important research interest of mine because it is surprisingly important and could be informative to many issues.

Advertisements Share this: