Items in italics are direct quotes from the articles below

http://www.marketwatch.com/story/robert-kiyosaki-on-americas-middle-class-its-the-white-collar-workers-who-are-in-trouble-2017-04-25

The Pew Research Center, a nonprofit think tank in Washington, D.C., released a major report Monday on America’s shrinking middle class. Robert Kiyosaki, the author of personal finance best seller “Rich Dad Poor Dad,” and real-estate investor, says the middle class has it harder now than when he was coming of age. This interview has been condensed for space:

MarketWatch: How do you think our idea and definition of the “middle class” has changed over time?

Robert Kiyosaki: I’m a baby boomer, and I left school in 1969. We had it really easy: plenty of jobs, high-paying jobs. You could put money in the stock market, it went up. Put it in a house, it went up. There was health insurance and retirement plans. That all changed in 1971 when [U.S. President Richard] Nixon took the dollar off the gold standard. Then you had globalization, and jobs started to disappear. That’s putting a tremendous strain on any remaining middle class.

In the article, Robert references “Rise of the Robots” by Martin Ford. This book is about the acceleration of technology and artificial intelligence replacing workers. Robert argues one of the most endangered species is a male that is 50 years old, who is not tech savvy and at the tail end of the baby boom generation. Robert admits that Trump’s administration has good intentions, however he is simply a man. Robert suggests that the way to possibly save the middle class is to take advantage of the huge boom in entrepreneurship. Technology makes it easier for people to start a business at a lower cost, but you need to have core fundamentals. When you start a business you have to be mindful not just of your local market competition but your global competition too. A good friend who’s owend a small business for 20+ years has told me that he’s not successful, he’s a survivor. There is a secret inherent trait you must have to last in business.

http://www.investopedia.com/ask/answers/021115/what-formula-calculating-net-present-value-npv-excel.asp

Net present value (NPV) is a popular measure of profitability used in corporate budgeting to assess a given project’s potential return on investment (ROI). Because of the time value of the dollar, NPV takes into account the compounding of the discount rate over the duration of the project. (For related reading, see What are the disadvantages of using net present value as an investment criterion?)

The NPV of a project or investment reflects the degree to which cash inflow, or revenue, equals or exceeds the amount of investment capital required to fund it. When assessing multiple projects, businesses use NPV as a way of comparing their relative profitability to ensure that only the most lucrative ventures are pursued. A higher NPV indicates that the project or investment is more profitable.

To calculate NPV, the estimated cash outflow and inflow for each period must be established, as well as the expected discount rate. Though the exact figures can only be known after completion, fair estimates can be made by looking at the performance of similar projects or investments.

Due to the importance of the content of this article, I’ve included more quotes than usual.

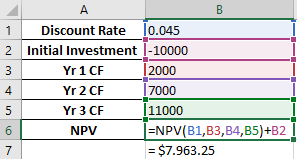

Assume a company wants to analyze the predicted profitability of a project that requires an initial outlay of $10,000. Over the course of three years, the project is expected to generate revenues of $2,000, $7,000 and $11,000, respectively. The anticipated discount rate is 4.5%. At first glance, it seems the returns are nearly double the investment. However, a dollar earned in three years is not as valuable as a dollar earned today, so the company’s accountant calculates the NPV as follows to determine profitability while accounting for the discounted time value of the projected revenues.

Manual Calculation:

NPV = {$2,000/(1+.045)^1} + {$7,000/(1+.045)^2} + {$11,000/(1+.045)^3} – $10,000

= $1,913.88 + $6,410.11 + $9,639.26 – $10,000

= $7,963.25

Excel Calculation:

Time is your most valuable of your assets. You shouldn’t waste it. This simple calculation will give you an idea if an investment is worth your time. However knowing the owner, the management team, the vision, and the mission will give you a better insight into a business’s intrinsic value. There are some things that the numbers will not tell you. Also remember that even though the numbers don’t lie, they can be fabricated too. If you have the luxury of sitting down with a business owner then ask questions and hear his soul.

If you need are interested in creating a budget, then contact me for a financial checkup in the contact me section. Also, learn more about the self-lending principle in the mustard seed section.

For this week, I’ve included THIS DREAM HAUNTS ME – 2017 MOTIVATION from Basquiat Picasso YouTube channel.

“If you think you know it all, you’re a fool for sure; real survivors learn wisdom from others.”

Proverbs 28:26 MSG