Gareth Slee. “I didn’t feel like I had won the lottery, but it is not far off”

Jo Cumbo’s article on the “Great Pensions Cash-in” has been given promoted to the FT’s “Big Read” – so it should be. It’s a fine piece of work and it has a brilliant opening which I will quote because many readers of this blog will know just how Gareth Slee feels.

Gareth Slee cannot believe his luck.

“The money is life-changing for me,”

says the 55-year-old former steelworker who has traded in his gold-plated final salary pension for a six-figure cash sum.

“I will never have to work again. I didn’t feel like I had won the lottery, but it is not far off.”

Gareth Slee is one of more than 220,000 people in Britain who have taken the irreversible step over the past two years to opt out of schemes with secure retirement benefits and shift their money into riskier personal pensions, where cash can be used to pay down mortgages, buy new cars or spend in one go.

“I know it’s risky but I trust my adviser,”

The value of money changes over timesays Mr Slee, a native of Port Talbot in Wales.

I can remember the first time my monthly gross pay passed £1000, I ‘d been working a few years before it did and my first five yearly tax returns ( I was self-employed 1983-92) didn’t see me declaring more than £10,000 . And yet I lived in central London and got married in these years.

If somebody had handed me £100,000 in cash in 1995 and told me that I need not work again, I would have reacted like Gareth Slee. All my Christmases would have come at once. I would have gone back at work within a few months (as the FT have found many have to).

I was young, “pensioners” aren’t. Gareth at 25 had a work expectancy equivalent to his life expectancy today.

Gareth’s transfer value reflects the risks in the promise he has from the British Steel Pension Scheme (less a 5% clip to reflect the deficit in the Scheme). It is in effect an equivalent to an offer being made to him at the start of his working life to pay all his salary up front.

If Gareth were to add up all his earnings from the late 70s till today, he might be shocked not just by the money he had earned – BUT BY THE MONEY HE HAD SPENT. If he was to do what actuaries do, and convert the amounts he earned 35 years ago into today’s pounds, Gareth would be gob-smacked

The value of money changes over time and people cannot see this. This is why Merryn Somerset Webb wrote an article in the FT “If I had a Final Salary Scheme, I’d cash it in“. Her boss, Martin Woolf, had such a scheme – and did. Gareth, Martin and Merryn are not stupid people.

Gareth is not stupid to be blinded by the “sexy-cash” (Steve Webb’s phrase) being dangled in front of him. Nor is he stupid to trust his financial adviser. If the world turns out as financial adviser’s models suggest, Gareth will happily draw-down his cash sum and possibly leave his wife with some of it when he dies. Investments will perform as planned, no major liabilities like nursing home fees will wipe out savings and Gareth will die conveniently according to his limited expectations.

There is nothing stupid in trusting a financial adviser, after all they are backed by substantial Professional Indemnity policies. Provided the adviser is around, Gareth should be ok . For PPF read PI – so long as the liability is still insured. This is the one-way bet that professional people laugh about when comparing the income multiples of the final salary pensions they have cashed out.

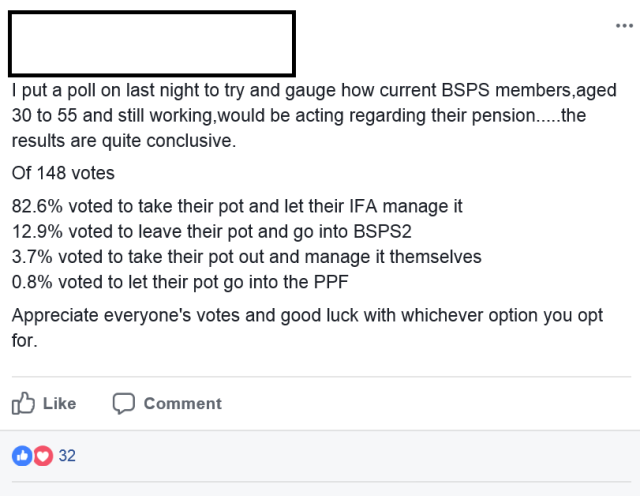

“Cashing-in” or “cashed-out”Careful readers will notice that I use a different preposition to Jo Cumbo. The “Great British Cash-Out” is different from a “Pensions Cash-In”. In my view, people are taking cash-out of an insurance policy that was designed to protect them from the impact of inflation, of the risks of market failure and of the long-term consequences of living longer and less healthily than expected”. If people considered a CETV as an alternative to those emotive security blankets, I doubt that we would have numbers that look like this.

Research from consultancy Willis Towers Watson says 55 per cent of pension scheme members, who are aged over 55 and who received advice paid for by their employer, decided to transfer. – FT

I am not sure whether schemes are proud of this statistic. The article points out that the transfers paid are well below the book-value of the liabilities, releasing the balance sheet of heavy oppression. Since the oppression was created by the artificial process of mark to market accounting and the impact of quantitative easing, I would be surprised if WTW considered the gains much more than “paper”.

People have “cashed-out”, but we will have to wait decades to find out if they “cashed-in”. In the meantime, many of the advisers will have retired and many of the PI policies will have lapsed. A different Government will be able to blame previous governments with the benefit of hindsight and articles like this will be yesterday’s news.

If Gareth’s money runs out, he will still have the NHS, the social security system and the “free-service” of the same ambulance chasers who are standing outside the gates of the Port Talbot steelworks.

That may not sound a great future, but it is becoming the default – implicit in BSPS’ “Time to Choose”.

Some one needs to check out this cashing-in, for it cannot end well Further readingHere are the Government stats updated 25th October, on uptake of pension freedoms.

Merryn Somerset Webb – if I had a Final Salary Scheme I’d cash it in.

Josephine Cumbo- UK retirees gambling away pension freedoms

Josephine Cumbo – Life Assurers rake in billions from Defined Benefit Transfers

Rate this:Share this: