Kingpin? Like the movie with Woody Harrelson and Randy Quaid about bowling?

(Bloomberg) — Trading patterns associated with the new kingpin in volatility options resurfaced on Wednesday, hours before concerns about trade protectionism roiled markets.

The so-called “VIX Elephant” — the moniker bestowed upon the options giant by Macro Risk Advisors head of derivatives strategy Pravit Chintawongvanich — traded more than 2 million contracts, closing out positions in January VIX options and rolling the trade over to same-strike options that mature the following month.

This entailed buying back 262,500 January VIX puts with a strike price of 12, selling 262,500 15 calls, and buying back 525,000 25 calls in order to close out the existing position. Then, the new position was established by selling 262,500 12 February puts, buying 262,500 15 calls, and selling 525,000 25 calls.

This particular trade, which stands to gain should implied equity volatility rise moderately, confirms a definitive shift in the Elephant’s buying and selling patterns.

“While the ‘Elephant’ originally traded three-month options, rolling after two months, they appear to have switched to a one-month cycle,” the strategist writes.

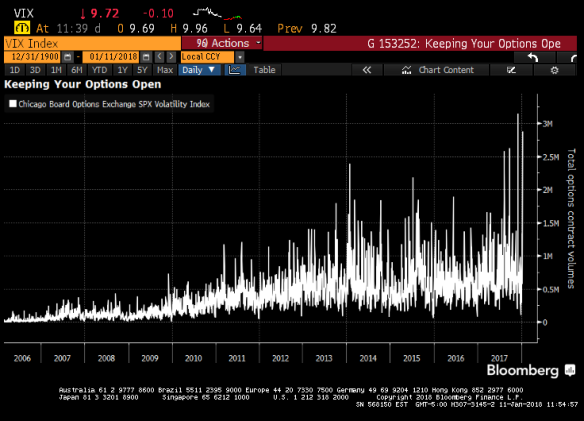

Daily volume in options tied to the Cboe Volatility Index hit their second-highest level on record Wednesday, exceeded only by the last time the Elephant — joined by another mystery volatility buyer known as “50 Cent” — went on the stampede at the start of December.

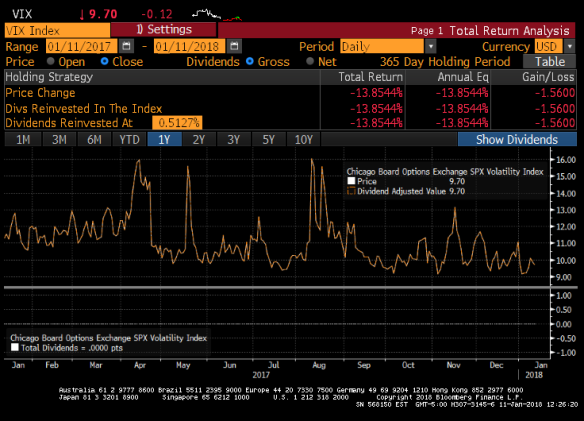

The 1 year holding period return (HRP) for the VIX is -13.85%.

The timing of that roll proved fortuitous: a spike in implied volatility allowed the Elephant’s previous positions to be closed at a loss of $2 million rather than $20 to $30 million.

However, Chintawongvanich estimates that this trader is down roughly $35 million since then as market calm prevailed.

“More generally, the ‘Elephant’ trades reflect a trend towards low premium outlay hedges with minimal convexity,” the strategist concludes. “Clients we talk to have been more interested in VIX call flies or S&P put flies that carry well and have a fairly low initial cost, but may not mark up as much as an outright option in a risk-off scenario.”

In other words, this Elephant might soon be seeing a new animal on safari: copycats.

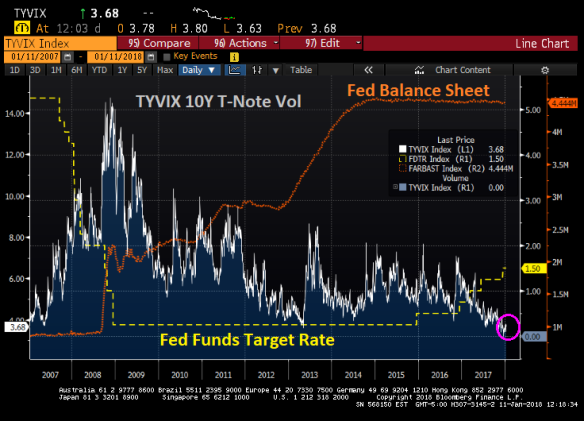

The Fed has just begun raising rates (only back to October 2008 levels) and barely unwinding their balance sheet. Apparently, there is considerable concern over an unraveling on the stock market with further rate increases/unwinding.

True, the trade picture is murky as is The Fed’s will to further raise rates and unwind its balance sheet.

10-year Treasury note volality remains extremely low with all the Central Bank microaggression.

Did someone mention Kingpin?

Advertisements Share this: