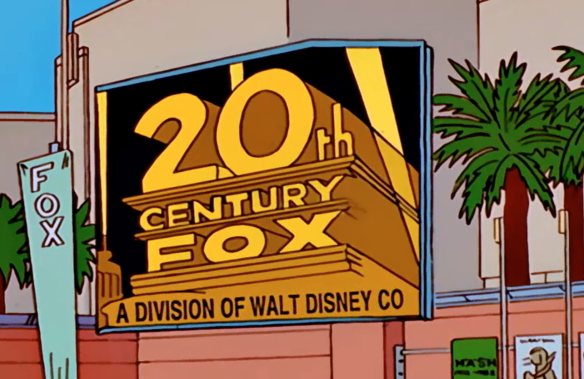

As highlighted in this week’s Sports Law Roundup, Disney and Fox are entering into a doozy of a media deal that involves everything from movies to television shows to streaming platforms to sports programming. This transaction has Star Wars components, Hulu components, and Simpsons components that, rightfully, are making headlines. It would not be surprising, however, if some of the most visible changes for viewers that result from this asset purchase, for which approval by various supervisory entities remains pending, come for consumers of sports media.

In an article out today, Will Leitch sheds some light on how this sale may affect the sports-media landscape:

The Fox Sports regional crews have been in place for so long that it’s unlikely for ESPN to fire everybody and start over. Other than the cross promotion — at least in the short term — your local games should look mostly the same.

But this play isn’t just about ESPN trying to take over local markets. It’s about, as everything is now, streaming. After ESPN purchased a majority share of Bamtech (the streaming and technology arm of MLB Advanced Media and the unquestioned behemoth in the space of online video) in August, they cleared the field to launch ESPN Plus, a standalone streaming service meant to help offset the increasing number of cordcutters who have eaten into ESPN’s bottom line in recent years, in 2018.

ESPN Plus likely won’t have immediate access to those regional games; there are existing deals in place that have to expire. But when they do, ESPN could negotiate new deals that would require would-be viewers to subscribe to ESPN (or ESPN Plus, or both) just to watch their local sports franchises. That would allow ESPN to own your sports fans experience at both ends: Locally and nationally.

“You have to look at the RSNs as a complement to ESPN, not an overlap,” Disney CEO Bob Iger said Thursday on CNBC. “There will be a sharing of product so that we can infuse ESPN national with some more local content … The result will be that both will be better.” Or, the result could simply be that you will be unable to avoid either.

Matt Bonesteel made a key point in “The Washington Post”: “This isn’t an entertainment deal; it’s a sports deal,” he wrote. “The total price tag of the Disney-Fox deal is estimated to be $52.4 billion. CNBC’s David Faber estimates that Fox’s RSNs alone would be valued at $20 billion, or more than 38 percent of that amount.”

So as a viewer and a fan of your local sports teams, you might not notice the ramifications of this deal (outside of branding) for a few years. But if you want to watch your favorite team, eventually, you’re going to have to pay Disney and ESPN to do it.

As for FS1 and company? Well, they were barely keeping their heads above water when they had the promotion from the RSNs. Now that the local networks are gone, they have only the Fox broadcast channel — which does still have the National Football League, a national MLB contract and next year’s World Cup — on their side and an entire stronger-than-before sports industrial complex stacked against them.

(The full article is available here.)

Not mentioned in Leitch’s article is that funding, distribution, and programming changes for the Fox RSNs once under Disney control could have significant consequences for professional sports teams, which derive a significant amount of their revenue from the sale of the rights to broadcast their games to these networks.

Long before the Disney-Fox deal was on the horizon, I had pegged 2018 as an important year for the Detroit Tigers, who then were beginning to strain under the burden of a ballooning payroll, because of the revenue relief that likely would come in the form of a new television contract:

Baseball might not grip the nation the way it once did and the way football now does, but the sport is extremely popular on a local level, making teams’ local broadcast rights as valuable as ever. The increasing price of these contracts means that the only thing better than a rich television contract is a new television contract. New television contracts are the things of which dreams are made– assuming you dream of signing a Zack-Greinke-caliber player or two.

Thus, the good news for Detroit: right about the time things could start to get ugly, payroll-wise, the team will be signing a new TV deal. Their current agreement, with Fox Sports Detroit, expires in 2018. As this Crain’s Detroit Business article highlights, the team has a few options, including negotiating an extension with FSD. It also could attempt to negotiate an ownership stake in whichever broadcast network it partners with going forward, something roughly half of the MLB clubs have done.

By 2018, the Tigers’ payroll may appear bloated in all the wrong places, but a timely new TV deal could render that bloat irrelevant, and it could allow the team to continue to be competitive– “keep[ing] the foot . . . on the pedal, hard“– for years to come.

With 2018 fast approaching, the team finds itself in a much different position than I had optimistically anticipated when I wrote those words in early 2016. At that time, I had hoped that new money, either from a contract extension with Fox Sports Detroit or a new contract with a different regional network, would better allow the team to afford the money due to Miguel Cabrera, Justin Verlander, Victor Martinez, Ian Kinsler, and Jordan Zimmermann; soften the blow of the Anibal Sanchez contract; and retain the likes of J.D. Martinez. Now, most of those guys are gone, thankfully (in light of the circumstances) with most of their contracts as well, though, and that payroll ledger looks much different than it did then:

(Click here for an expanded view. Not pictured: Sanchez buyout ($5 million in 2018); Verlander share ($16 million across 2018-19); Prince Fielder share ($18 million across 2018-20).)

As signs of an impending rebuild raced into view faster than expected, I wondered whether the team, more and more clearly facing down years in the near future, might consider an early renegotiation of the FSD agreement to try to capitalize on better audience numbers while the relatively good times lasted. Like some of the ideas I propose here, that didn’t happen. The good news is that it may not matter. A recent analysis indicates that the viewership drop is unlikely to serve as a significant detriment to the value of the Tigers’ next television contract:

Though viewership fell, and got worse over the course of the season as the team shed players and hope, ratings that are still among the top 10 in baseball will mean a lot when the Tigers and Fox Sports Detroit are expected to work out a new broadcast rights deal that could top $1 billion-plus over a decade or more.

. . .

For at least the short term, data shows that the two primary audience metrics for Tigers baseball — game attendance at Comerica Park and ratings on local TV — are declining. Offsetting some of that TV decline is digital audience growth for Tigers games on computers and mobile devices, and the fact that the Tigers still dominate local TV viewing when they’re on.

. . .

So even while rebuilding, the Tigers have negotiating leverage for their next local TV deal, which will provide a significant portion of the team’s annual revenue.Their current broadcast rights deal with Southfield-based Fox Sports Detroit, owned by Fox Broadcasting Co. in Los Angeles, is for 10 years and pays the Tigers $500 million.

. . .

Fox Sports Detroit’s 151 Tigers broadcasts averaged an overall 4.48 household rating this season, sixth among MLB’s 29 U.S. teams (which combined to average a 2.91 rating this season, according to data from SportsBusiness Journal).

. . .

Still, as the Tigers’ fortunes slid, so did their ratings.FSD’s Tigers game averaged a 6.25 rating when the season began in April, and tapered off to a 1.06 by October — a trend that reflects the team fading in the standings and trading away star players.

. . .

The solid ratings, even while the team struggles, mean the short-term win-loss record doesn’t matter for long-term business purposes, said Lee Berke, president and CEO of Scarsdale, N.Y.-based sports media consulting firm LHB Sports, Entertainment & Media Inc. He’s a consultant for teams negotiating broadcast rights deals.“Bottom line, the Tigers will still dominate summer programing. Weeknights and weekends, (they) will be most watched on that day,” Burke said. “There are very few properties, sports or entertainment, that can provide that level of consistency for years and decades. That’s the strength of baseball, six months-plus of solid entertainment and a loyal fanbase.”

He predicted that the $50 million the Tigers get now annually from FSD could double to $100 million or more annually under a new deal.

(The full article is available here. Interestingly, this more recent Crain’s article appears to contradict earlier information indicating that the Tigers’ current ten-year contract with FSD ends in 2018: “The [current] contract was announced in 2008 and is believed to run from 2011-21 — no one involved has publicly disclosed the terms. A replacement deal or extension could be announced any time before then, but neither the network or team has been willing to comment on the topic.”)

Regardless of whether you believe this optimistic assessment, viewership trends merely are a component of the negotiation between team and network. The Disney-Fox agreement, by contrast, has the potential to change the very nature of these negotiations. While it appears that most of these team-network negotiations have occurred without significant oversight from a Fox parent company, it’s conceivable that ESPN would move to consolidate management of its new RSNs in order to accomplish an across-the-board cost reduction in broadcast-rights expenses by reclaiming some of the seemingly unbound leverage teams now possess by dealing with the RSNs individually. Of course, competitors (e.g., Root Sports (AT&T), Comcast (NBC)) will have something to say about these negotiations as the former Fox RSN deals expire and still could drive values in the teams’ favor.

______________________________________________________________

Related

Imagining a World Without ESPN