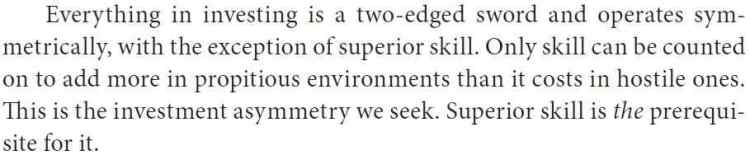

If our target is to achieve returns similar to the market returns with the similar risk & reward scenario then it’s not a difficult task. We just need to buy an index fund. But if we want to add a value to our targeted returns, different risk & reward scenario then we require a superior investment skill, superior insights which we have seen in second level thinking.

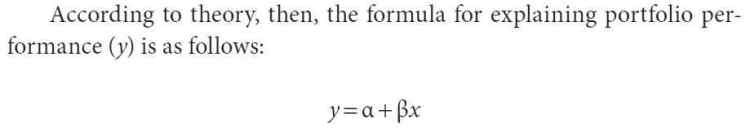

For the understanding, what actually mean for skillful investors to add value, we need to understand Beta – portfolio’s relative sensitivity to market movements. And Alpha – ability to generate performance unrelated to the movement of the market (I.e. personal skills).

While we are active investors then we have a number of options available to us.

1) We can decide that whether to build aggressive or defensive portfolio compared to the index, such characteristics of the portfolio is for temporary situations or for permanent. If we build an aggressive portfolio then it will increase a systematic risk of the portfolio that is beta.

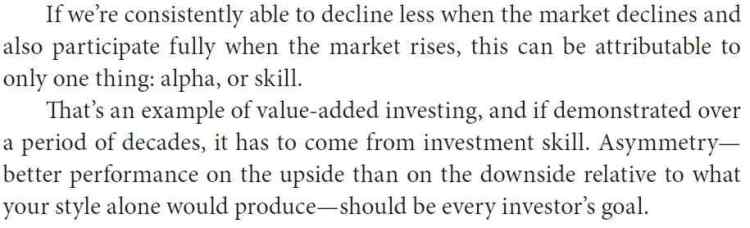

2) We can make a decision to get deviate from the index. We may buy few index stocks and exclude others or add stocks which are not the part of the index. As such portfolio gets diverted from the index so that return of portfolio also get deviate from the index. But in a long-term, the return of investors with superior insights will cover index return and can able to add value in terms of risk-reward scenario.

If we are managing our portfolio actively then we require having a second level thinking skill. If we do not have such superior insights then it is advisable to go with a passive investment. We need to shift a portfolio from aggressive or defensive as per the surrounding situation and need to avoid a frequent trades with the belief of generating a higher returns.

Different active investors hold different portfolios, some of those portfolios perform better than others portfolio, and some of the portfolios perform well during some particular time period. In a longer-term, active investors with superior insights can able to generate an above average risk-adjusted return. Combination of all different active portfolio reflects market behavior but in fact, all of those portfolios having different features.

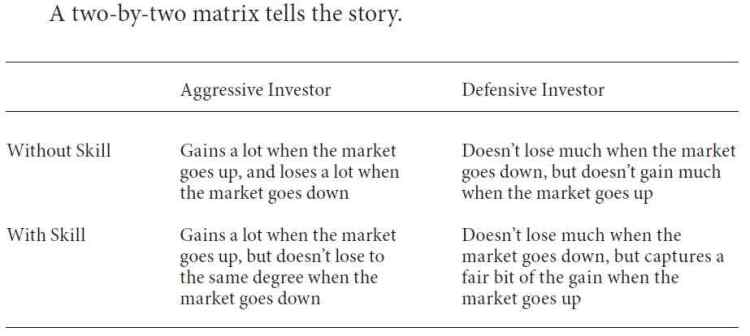

Aggressive investor’s portfolio can able to generate a higher returns compared index in a good time and lose more compared to the market in a bad time. This volatility is measured by beta.

If the Investors who generate higher returns with risky portfolio compared to other investors who generate average returns with low-risk portfolio then always we need to put more emphasis on the risk-adjusted return. But we cannot quantify each and every risk involves the portfolio. So that we need to accept that investment skills having an existence though everyone does not possess it.

If we don’t have any investment skill then we can able to achieve index return by making an investment in the index fund. Some of the investor’s portfolio fluctuates more compared to benchmark and few of the investor’s portfolio moves near to benchmark returns and few others can able to control risk and fall less. We get a different result at the different market scenario but our core focus should be on controlling risk and able to generate a risk-adjusted return.

In bad years, defensive investor’s lossless and in good years, aggressive investors make more money. So can we say that they are adding value? We cannot able to say anything about the value added by just seeing to the one-year performance of any investor. We can able to see the value added in a long term only.

Mr.Buffett, Mr.Howard Marks have mentioned that they like to increase average in good years and fall less in bad years. This provides them an advantage to adding value over a longer period of time. Protecting ourselves against the worst period is essential compared to the beat into the good period.

Read for more detail: The Most Important Thing Illuminated by Howard Marks

Advertisements Rate this: