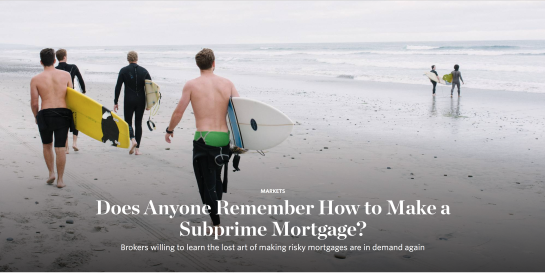

Brandon Boyd was a high school junior during the financial crisis. Now, the former Calvin Klein salesman is teaching mortgage brokers how to make subprime loans.

Brandon Boyd from Drop Mortgage in his office in Encinitas, Calif.

Mr. Boyd, a 25-year-old account executive at FundLoans in a beach town outside of San Diego, is at the cusp of efforts to bring back an army of salespeople who once powered the mortgage industry and, some say, contributed to the housing crisis.

Mortgage brokers, who serve as middlemen between lenders and borrowers, used to be a key part of the home-loan process. But some brokers faked loan applications and steered people into debt they couldn’t afford.

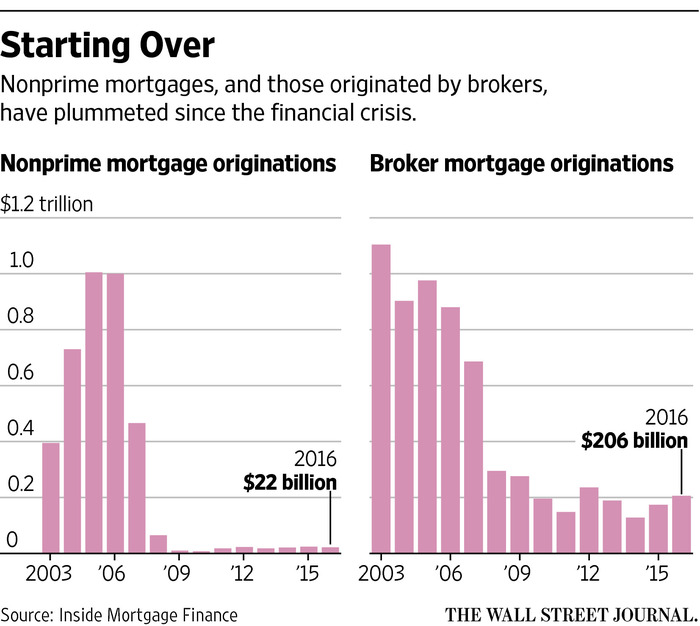

Financial regulation has severely diminished their ranks since the housing meltdown. And big banks with national sales teams say they won’t use brokers anymore because they are third-party contractors, making it harder to police loan quality.

Now, small and midsize independent lenders want the brokers back. Nonbank lenders that typically cater to riskier borrowers say they need brokers to fan out across the country and arrange mortgages to people with lower credit scores, or who can’t prove their income through a typical tax return.

Article continues:

Related

Article continues:

Related