Download links for: Capital in the 21st century

Reviews (see all)

Write review

Important stats in graphs. Long book. I only actually read a little, but this is an important work.

Best economics/finance book in 2014.

A triumph!

owns

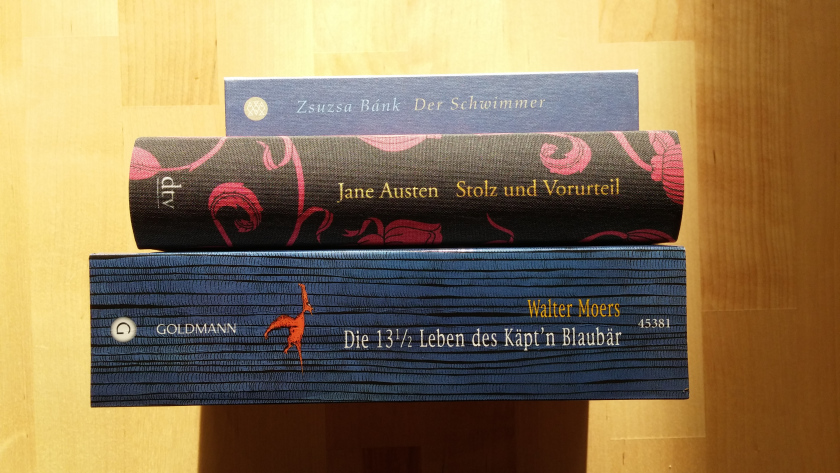

Other books by History & Biography

Other books by Thomas Piketty

Related articles