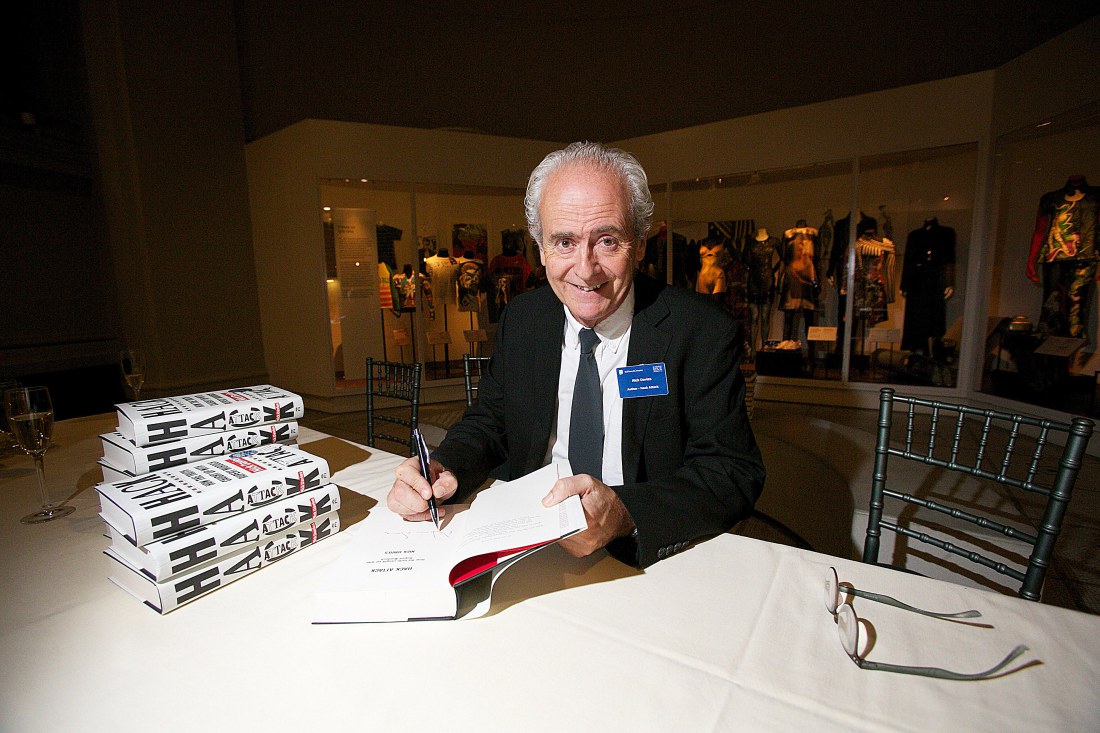

Download links for: The Hour Between Dog and Wolf: Risk Taking, Gut Feelings and the Biology of Boom and Bust

Reviews (see all)

Write review

A look at the biochemistry of decision-making behavior in the context of the stock trading floor.

Very good, 4.6. Examines the biology of risk-taking, particularly in the stock market.

excellent and thought provoking

I think the same way

what an eye opener

Other books by Nonfiction

Related articles