Decision journals are designed to create a log of the decisions you’ve made and why you made them. To both capture a snapshot of your thinking at the start, then use the notes to improve your decision making process when you review it later.

I first heard about decision journaling when Ian Stewart pointed to a Farnham Street post a few years back. Then it came up again in late 2017 via Matt on the OFF RCRD podcast. I decided to take another look.

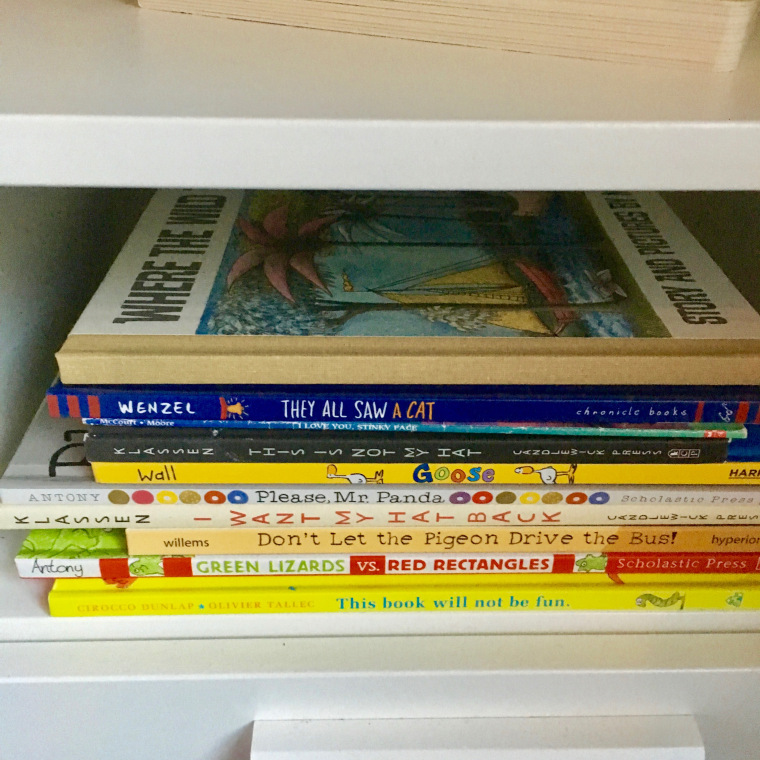

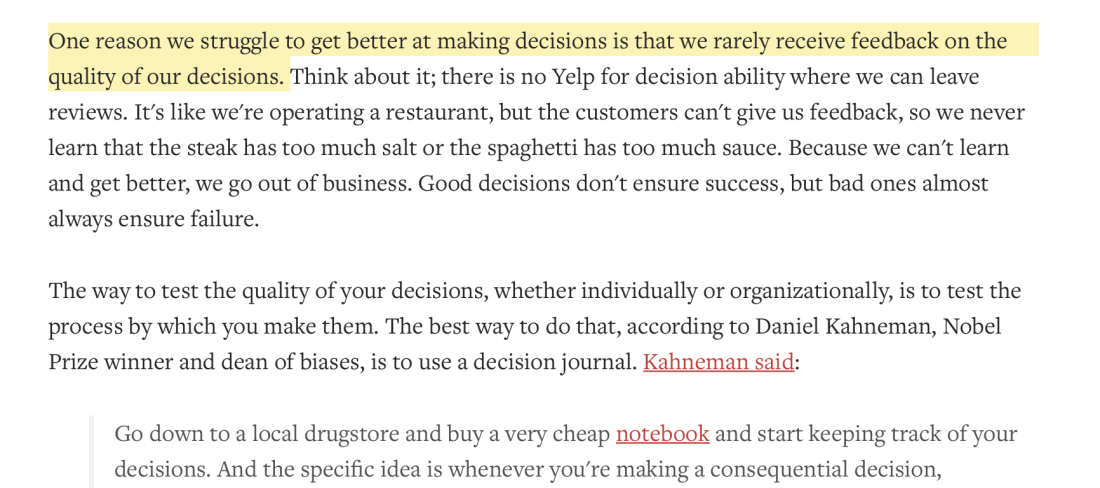

Screenshot of the Farnham Street post about decision journals, highlighting the need for quality control of our decisions.

Screenshot of the Farnham Street post about decision journals, highlighting the need for quality control of our decisions.

“You can think of a decision journal as quality control” for your decisions — yes, that fits my mindset. A quality check in six months or a year to prevent hindsight bias.

Here’s the Farnham Street template as a downloadable PDF: Decision Journal Template.

I haven’t made this a standard practice yet, probably because it feels like too much overhead. These days when reviewing success and failure I find myself reflecting back without a full picture of where my mind was at the start. What have a I learned in between? Will I repeat the same mistakes? How can I repeat the top bets that paid off?

For example, for a given decision, what do I expect to change? What am I betting on, and how will I know if I’m right or wrong?

In 2018 I hope to be better at stating my intentions ahead — taking the time to create the snapshot of my thinking at the start. Blogging this publicly to keep myself accountable for journaling the decisions at the start.

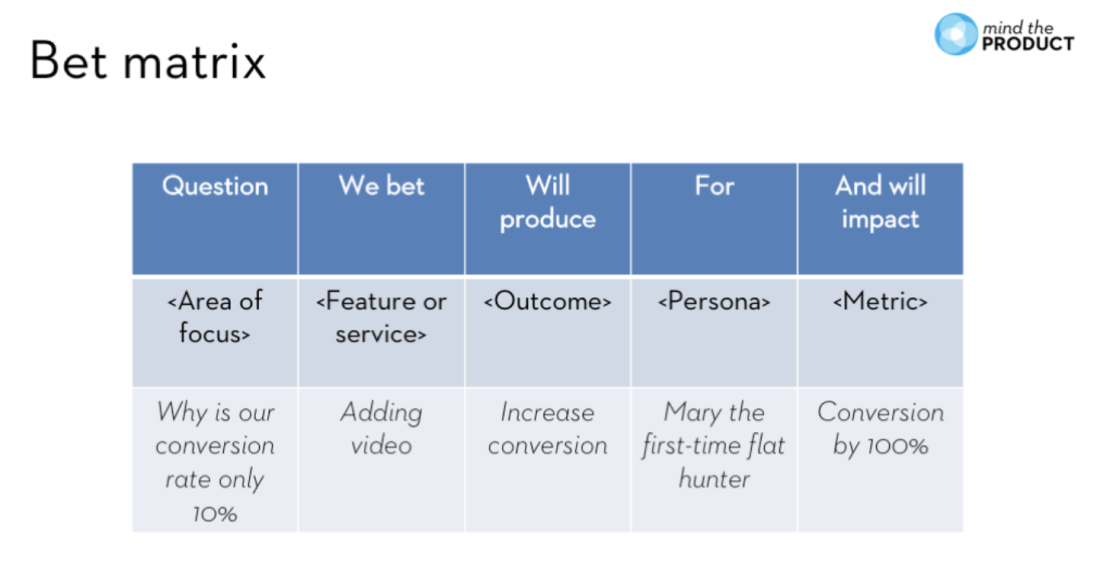

Bonus: Two recent mental models for framing your decisions as “bets” that I’ve come across, in case you find them helpful.

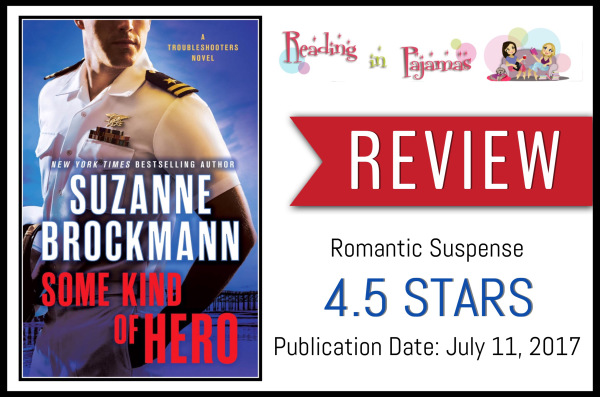

Screenshot of the Bet Matrix by Mind the Product.

Screenshot of the Bet Matrix by Mind the Product.

Make your decisions as expected value calculations. Think of every decision as a bet with a probability and a reward for being right and a probability and a penalty for being wrong. Suppose something that has only a one-in-five chance (20%) of succeeding will return ten times (e.g., $1,000) the amount that it will cost you if it fails ($100). Its expected value is positive ($120), so it’s probably a smart decision, even though the odds are against you, as long as you can also cover the loss.

Share this: