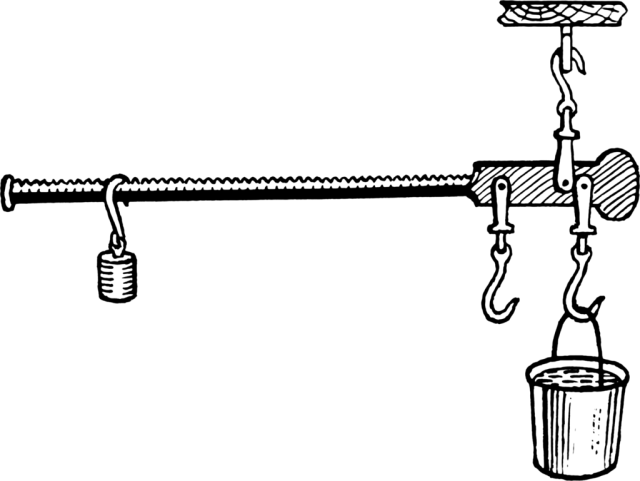

A rule of thumb … stating that, when one is comparing two hypotheses, they should be placed on the arms of a metaphorical steelyard (a kind of primitive scale, consisting of an arm free to pivot around a central fulcrum) and preference given to the one that “rises higher”, presumably because it weighs less; the upshot being that simpler, more “lightweight” hypotheses are preferable to those that are “heavier”, ie more complex.

Neal Stephenson, Anathem

This from a favourite author, Neal Stephenson. It’s pulled from a fictional work, “Anathem“. It’s here because it’s a cute way of saying, “choose simple before complex”.

Most explanations in the forex world sound really complex, Support/ resistance here, kangaroo tails there, Elliott Waves someplace else. Oh – and they sell a lot of books as well.

Flip a coin. You have a comparable chance of grabbing a winning trade.

I think you can put all that to one side.

Success is all about risk management. The winners manage their risk. They have rules and systems, and don’t let emotion influence their decisions. For the 10%’ers, forex trading is a business.

Losers look for the easy wins. The secret tricks. The indicators and patterns that for sure will flag a rising (or falling) trend. These are the 90%’ers, easy fodder for the brokers.

Look for simple. Understand it well.

Thanks for being here.

Photo by Jakub Skafiriak on Unsplash. Steelyard image by Pearson Scott Foresman [Public domain], via Wikimedia Commons.

Advertisements Share this: