Some people are skinny fat, I’m rich poor.

According to CNN Money, my household income is in the top 6% of the country. But for reasons I’ll detail later—like my insane credit card debt—it’s time to resolve to embark on a year of no shopping, that is, no shopping for clothes, bags, jewelry, or shoes, and to rein in my wanton grocery shopping.

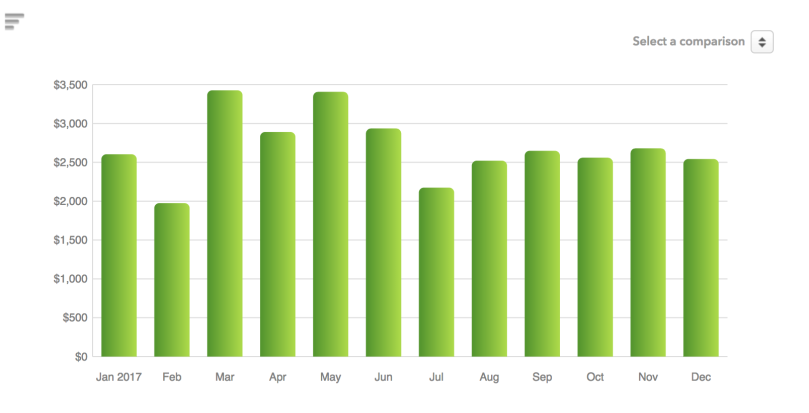

Stopping frivolous spending is obviously worthwhile, especially given how many pairs of Fluevogs I own. But food? I’m going on a grocery budget because my family of 3, sometimes 4 when one kid is home from college, has been spending an obscene amount on groceries, on average about $1,800. Add in alcohol and restaurants, and it comes to an outrageous $2,700 per month.

Compare that to what is supposedly the average of $151 per week (times 4.2 that’s $634/month) or what one site recommends at $125 per person per month, which would for us be about $450 a month!!! Even the generous USDA site says that extravagant spending would amount to about $1,000 a month for our family. I don’t want to be extravagant, but I can’t begin to fathom how to spend as little as $600 per month on food and drink, so I am going to do my best to keep the food and dining bill to under $900 a month.

Resolved… Ready, set, go to

- a year of no shopping for clothes, bags, jewelry, or shoes

- a food and drink budget of $900 a month.

As of December 31, 2017, this is a brand new blog, so I have at the moment zero readers. But if one or two or more happen by, feel free to leave a comment, confidentiality guaranteed. Are you struggling with anything like this? Or am I truly alone with this embarrassing dilemma. Are you embarrassed by your extravagance? Or living beyond your means? Or maybe just super irritated that I am complaining about my first world problems?

Related