Disclaimer: Some links in the following post are referral links. I will get a bonus if you use the links. If you have found these posts helpful so far I would be very appreciative if you used my referral links. If you have not found them helpful you can sign up through American Express directly. I will never post anything that does not benefit you in any way or any product that I myself would not use or do not already have.

Last week we talked about the non-AMEX cards, the week before we talked about the main AMEX cards and this week we will talk about the “other” AMEX cards.

I say other because they aren’t a part of the charge card (Business Platinum, Personal Platinum, Business Gold, and Personal Gold) family that earns Membership Rewards (MR) that can be transferred to Aeroplan or other airlines. These ones are hotel specific.

Starwood Preferred Guest (SPG), now owned by Marriott, is a very large corporation that runs a huge hotel chain.

What is so great about SPG?

SPG Starpoints are one of, if not the most, valuable points you can have. That is because they are so versatile and give you direct access to world class hotels.

Starpoints can be transferred to almost any airline. Plus, when you transfer in groups of 20,000, SPG will give you a bonus 5,000 points. So, 20,000 Starpoints points = 25,000 airline points no matter which airline you decide to transfer to.

SPG has over 1,500 hotels in 100 countries across 11 brands. Their most famous line being the St. Regis Hotels. Rooms come with butlers at your service and are the most superior line of hotels SPG has to offer. They also have W Hotels which is their modern luxury brand of hotels. And of course, their Luxury Collection with some of the most expensive hotels you can find like the Gritti Palace in Venice, Italy where a weekend night in the summer will cost you over $1,600 per night! OR Mystique in Santorini, Greece where a weekend night in the summer will cost you almost $1,800 per night! You can see and dream of all of their brands of hotels here.

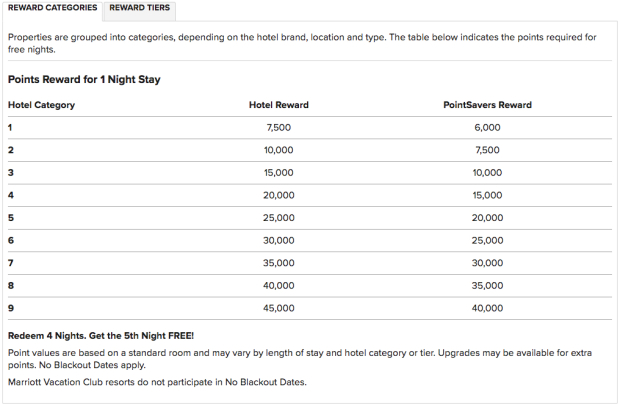

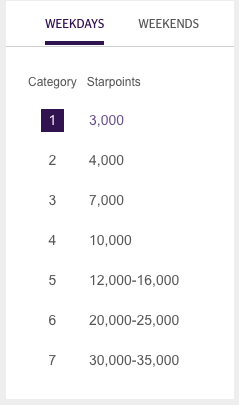

My personal favourite thing about SPG is that 1 Starpoint = 3 Marriott points. Marriott points are valued at about 1.17 cents per point and SPG points are valued at about 3.51 cents per point. I’ll explain what that actually means in a future post but for now, 3.51 is bigger than 1.17 is all you know need to know. Since I said 1 Starpoint is equal to 3 Marriott points if we go 1.17 x 3 = 3.51. The math checks out. How we can use this to our advantage is by redeeming for high category Marriott properties at a fraction of the cost of top end SPG properties. Here’s what I mean, see the charts below:

Marriott Rewards Redemption Chart

SPG Starpoints Redemption Chart

As a note, the only difference in the Weekend Redemption rate on the SPG chart is that the Category 1 and 2 redemptions are 1,000 points cheaper on weekends.

Now, let’s assume we want to stay at the highest category hotel in each program for one night. For SPG we will need, on the low end, 30,000 Starpoints. At Marriott, we will need 45,000 Marriott Rewards points. But remember, 1 Starpoint = 3 Marriott points so that 45,000 point room is really only 15,000 Starpoints since we can transfer at 1:3. That only gets us SPG’s 3rd best category whereas we get Marriott’s best category for the same price. Both programs are awesome but I’m just trying to show you the value in Starpoints when transferred to Marriott.

For those wondering, PointSavers is basically a sale on points redemptions for hotels. If we check out Marriott’s PointSavers page right now we will see which hotels currently have discounts for which dates.

Marriott also owns the Ritz-Carlton brand of hotels but we will discuss that in a future post. Basically, they’re more expensive but it’s an amazing opportunity because most of us would never stay there in cash but with points it’s possible.

How do I earn SPG Starpoints?

You guessed it, credit cards. There are two cards available to us Canadians to earn Starpoints points directly:

SPG Personal Credit Card

- 20,000 Starpoints after minimum spend is met

- $1,500 minimum spend in the first 90 days

- $120 annual fee

- 2 Starpoints per $1 spent at SPG or Marriott hotels until February 15, 2018

- 1 Starpoint per $1 spent on all spend

- SPG Gold status after $30,000 spend annually

- 1 free night at a Category 1-4 hotel after $40,000 spend annually

You can apply for the SPG Personal Credit Card here. Scroll down to “Other Cards” and click on SPG Personal then click ‘Apply now’.

SPG Business Credit Card

- 20,000 Starpoints after minimum spend is met

- $1,500 minimum spend in the first 90 days

- $150 annual fee

- 2 Starpoints per $1 spent at SPG or Marriott hotels until February 15, 2018

- 1 Starpoint per $1 spent on all spend

- SPG Gold status after $30,000 spend annually

- 1 free night at a Category 1-4 hotel after $40,000 spend annually

You can apply for the SPG Business Credit Card here. If you do not have a business you can still get a business card.

AMEX Canada has a rule where you can only have 2 credit cards at one time through AMEX. AMEX cards are broken down into two categories: charge cards and credit cards. At the end of the Churning Basics post there is more information about the difference between the two but basically charge cards have to have their balance paid in full each month and credit cards have a minimum payment. There is more detail in that post.

The credit cards we are concerned with are: SPG Personal Credit Card, SPG Business Credit Card, and the American Express Cobalt Credit Card. You can only hold 2 of these at one time so you must choose which 2. Let’s first break down the American Express Cobalt Credit Card.

American Express Cobalt Credit Card

- 10,000 Membership Rewards (MR) welcome bonus after minimum spend is met if you apply before January 30, 2018

- $3,000 minimum spend in the first 90 days if you applied for the card before January 30, 2018

- $10 monthly fee

- 2,500 MR bonus points after monthly spend of $500.

- 5 MR per $1 spent at grocery stores, restaurants, bars, and food delivery services

- 2 MR per $1 spent on travel, gas, and transit

- 1 MR per $1 spent on all other categories

This is a brand new type of card that AMEX seems to be trying out. They marketed it as a “card for millenials”. It seems to have worked as it is already one of their most popular cards. That, or, people are just intrigued by it.

The Cobalt card seems kind of like the anti-churning card with the monthly fee and minimum monthly spend to get points. That being said, this is a very good card if your goal is hotel points. Before I explain why, I have to explain AMEX MR categories.

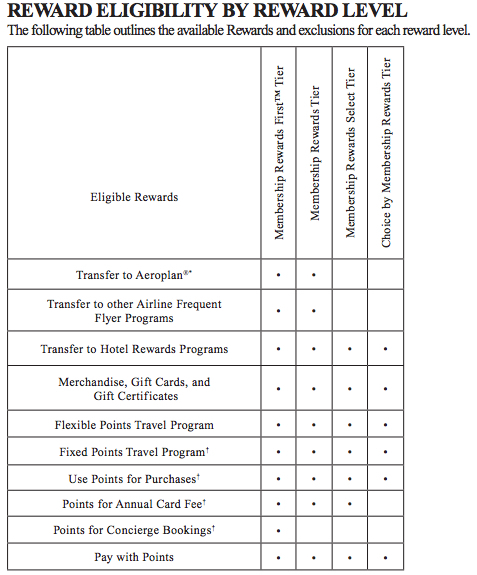

You can earn MR through AMEX in 3 categories: MR First, MR, MR Select, and Choice MR. The chart below will show you the differences.

As you can see, the biggest difference is that MR Select can not be transferred to Airline Frequent Flyer Programs. That isn’t a huge deal as we can still transfer them to Hotel Rewards Programs, like SPG.

How do I maximize these cards?

The two SPG cards are easy to maximize their value because they should really be your everyday spend cards wherever AMEX is taken. That is assuming you are not trying to meet a minimum spend on another card, you aren’t spending at a bonus category, and you aren’t collecting specific points for an upcoming redemption.

The Cobalt card is really only valuable when spending on food. Every time we spend $1 on food we get 5 MR Select. MR (of all types) transfer to SPG at a 2:1 ratio, 2 MR = 1 Starpoint. So, every $1 we spend on food gets us 5 MR Select which is 2.5 Starpoints. Since, MR Select, which you collect with Cobalt, are only able to transfer to hotel programs, this is the best option. From there you can either keep the Starpoints to redeem at a SPG hotel, transfer to an airline in chunks of 20,000 to get the 5,000 point bonus or transfer to Marriott at 1:3.

Hopefully this post has helped you to see the crazy value in Starpoints due to their versatility and the access they provide you to world class hotels.

If you have any questions, feel free to comment or email us at adventureneverenns@gmail.com

Never stop adventuring!

Share this: