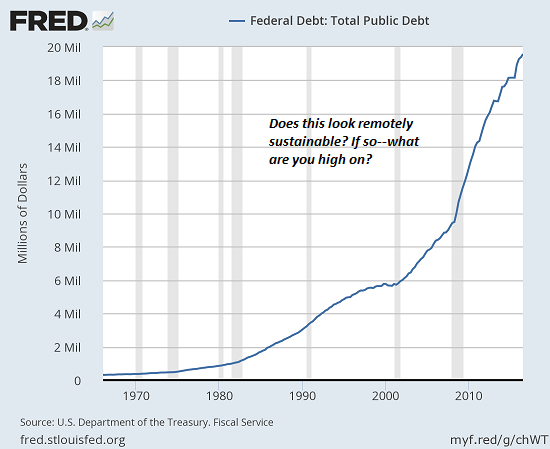

Debt can pump up an economy. Invariably, it also takes it down. From Charles Hugh Smith at oftwominds.com:

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy’s going great–but at what cost? “Normalcy” has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced–but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the costs exceed the gains by a wide margin. As long as the costs can be hidden, diluted, minimized and rationalized, then phantom gains can be presented as real. Exhibit One: the US public debt. If you borrow and blow enough money, it’s not too difficult to generate a bit of “growth”–but at what cost? Exhibit Two: opioid deaths. One of the few metrics that’s climbing as fast as the national debt is the death rate from prescription and synthetic opioids:

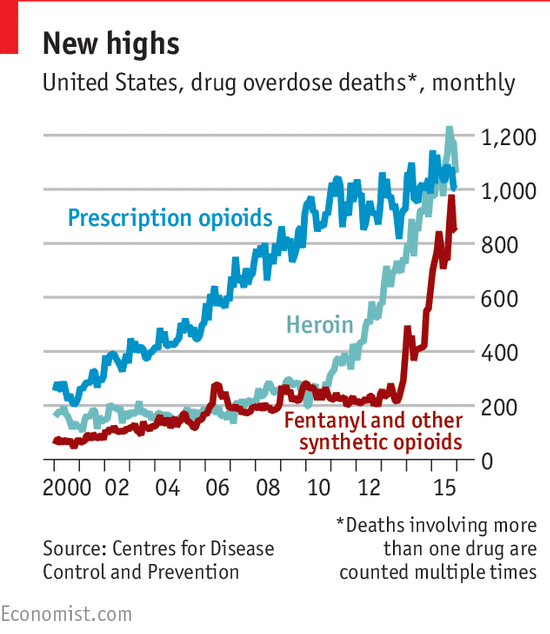

Exhibit Two: opioid deaths. One of the few metrics that’s climbing as fast as the national debt is the death rate from prescription and synthetic opioids:

Exhibit Three: student loan debt. Here’s a chart of debt that is federally originated but paid by individual students: the infamous student loan debt that has shot up over $1 trillion in a few years.

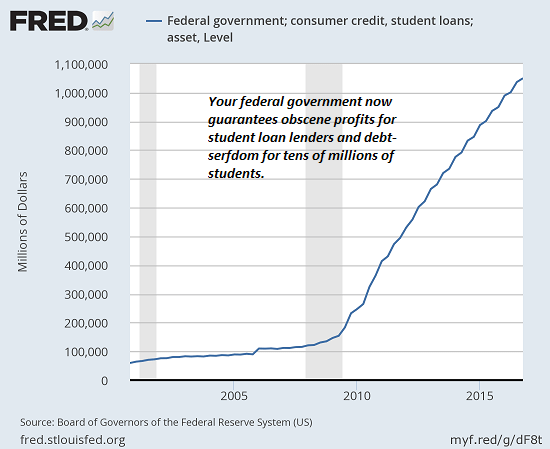

Exhibit Three: student loan debt. Here’s a chart of debt that is federally originated but paid by individual students: the infamous student loan debt that has shot up over $1 trillion in a few years.

You see the point: the cost are skyrocketing but the gains are diminishing. The costs of maintaining the illusion of “normalcy”–for example, that going to college is “still affordable”– are soaring, while the gains of a college education are declining as credentials and diplomas are is oversupply. (What’s scarce are the real-world skillsets employers actually need.)

To continue reading: Yes, But at What Cost?

Advertisements

Share this:

You see the point: the cost are skyrocketing but the gains are diminishing. The costs of maintaining the illusion of “normalcy”–for example, that going to college is “still affordable”– are soaring, while the gains of a college education are declining as credentials and diplomas are is oversupply. (What’s scarce are the real-world skillsets employers actually need.)

To continue reading: Yes, But at What Cost?

Advertisements

Share this:- More