The automobile industry is a sector that has long recognized the importance of geographical planning and analysis. All the main auto manufacturers distribute their products to the market via a network of franchise dealers. These dealers are independent businesses but are allocated an exclusive geographical territory to which the manufacturer agrees not to assign any other dealer, subject to the existing dealer meeting certain performance criteria. Clearly most manufacturers aim to maximize their market share and profitability in their market. From analysis of the voluminous amounts of registration data it is clear that there is a very strong relationship between market share and dealer location. In other words the more dealers the manufacturer appoints. The greater the likely market share. However, this is traded off against the fact that as market share increases there are diminishing returns and the sales of each dealer reduce, thus affecting individual dealer profitability and, possibly, the scope for retail price discounting. As a consequence, manufacturers are trying to find a balance between maximizing market share whilst at the same time ensuring that each individual dealership is a profitable business in its own right.

Achieving this balance requires a thorough understanding of existing market performance and the ability to examine alternative scenarios through an intelligent GIS approach.

CASE STUDY

The automobile industry is a sector that has long recognized the importance of geographical planning and analysis. All the main auto manufacturers distribute their products to the market via a network of franchise dealers. These dealers are independent businesses but are allocated an exclusive geographical territory to which the manufacturer agrees not to assign any other dealer, subject to the existing dealer meeting certain performance criteria. Clearly most manufacturers aim to maximize their market share and profitability and, possibly, the scope for retail price discounting. As a market share whilst at the same time ensuring that each individual dealership is a profitable business in its own right.

Achieving this balance requires a thorough understanding of existing market performance and the ability to examine alternative scenarios through an intelligent GIS approach.

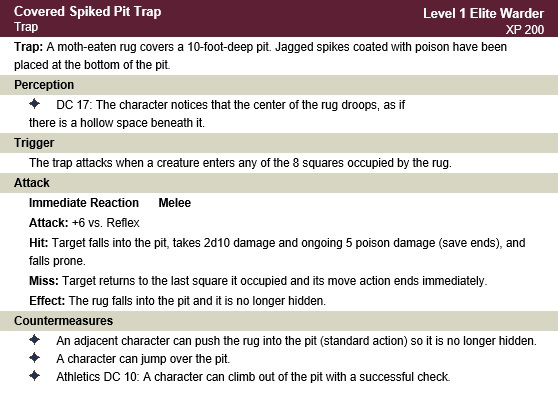

The particular case study that we will use to illustrate the benefits of this type of approach is based on the analysis of the Toyota network in Seattle, Washington State, US. The specific question that we wish to address is: are there possibilities of extending the Toyota network in Seattle in such a way as to generate incremental sales and market share without detrimentally affecting the viability of existing Toyota dealers, and at the same time of creating successful new dealerships in their own right? These sorts of question demand a new type of analytical solution known as optimization models, which although well known to quantitative geographers are generally not available in proprietary GIS. The methodology involves embedding a spatial-interaction model within an optimization routine so that the model will systematically search for solutions which satisfy constraint input by the analyst. In the Toyota example the objective function was the maximization of market share subjected to the following constraints:

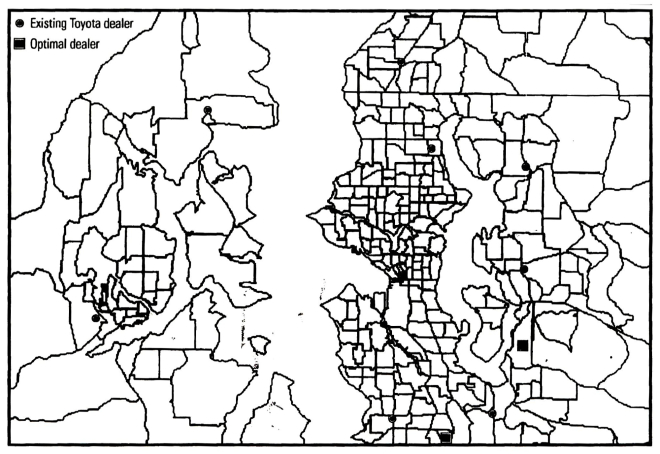

Figure. Optimal location of two new dealerships (at least 13 minutes’ drive time between dealers)

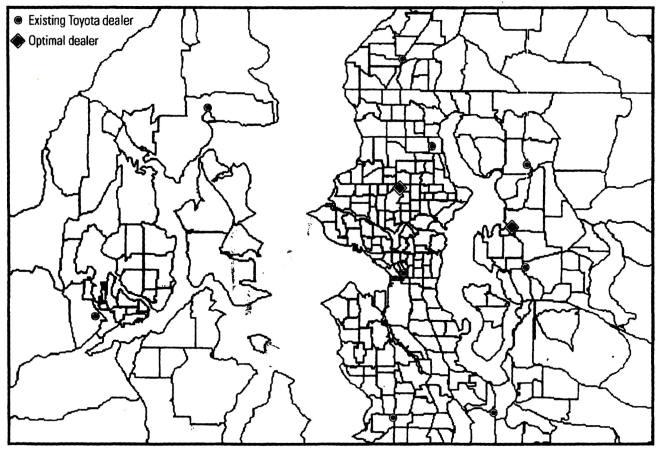

The heuristic thus developed solved this problem and also accounted for exclusion of certain areas of the region where a location would not have been feasible – for example a park or a census tract zoned for residential use. The illustration examines two different problems. In the first we wish to identify the optimum location of two new dealers in the Seattle area which will have a minimum sales throughput 450 cars per year and be more than 13 minutes drive time away from an existing Toyota dealer. In this case the solution identifies two dealers which will generate incremental sales of almost 750 Toyota vehicles in the Seattle region (see the figure). The second example relaxes the drive-time criterion to identify two new dealers with a minimum of 600 sales but at least 10 minutes drive time from an existing dealer. In this case a solution was identified but the locations were markedly different from the first example (see the next figure). However, almost 1000 incremental sales were generated in this second example. Based on 1000 incremental sales and given an estimated profitability of $1500 per vehicle, the potential benefit to Toyota is in the region of $1.5 million per year in this single market. Given that there are in the order of 80 markets of a similar size to Seattle in the US, the exercise repeated across the country could generate benefits of well over $100 million per annum. Even if the figure was only 10 per cent of this, then the benefits would far outweigh the costs of developing such a system.

Figure. Optimal location of two new dealerships (at least 10 minutes’ drive time between dealers)

Share this: