The best part about personal finance is, well, the fact that it’s personal! You can budget however you want and as long as it’s working for you then it’s doing it’s job. There’s some guidelines that you should be following and some steps that you should be taking in order to get to that perfect personal budget.

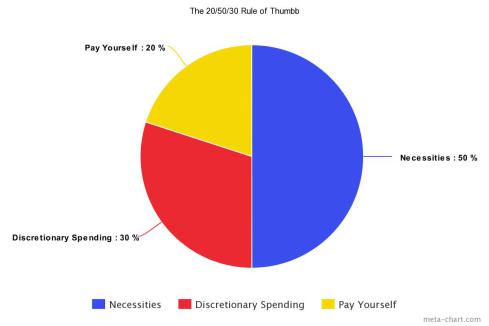

The 20/50/30 rule of thumb.

The 20/50/30 rule of thumb is a guideline about how you should be splitting up your income in your budget. Using this guideline, 20% of your income goes towards your financial goals, 50% of your income goes towards your necessities, and 30% of your monthly income goes towards discretionary spending. It’s a very simple way to break down your budget and a good starting point for those creating a budget for the first time.

Figure out how much you’re making on a monthly basis.

Yeah, this is important. If you don’t know how much you make, how are you going to know how you’re going to cover your expenses? Or how much you can save? This is a fairly simple thing to figure out.

If you’re paid weekly, monthly income = (average paycheck x 52 pay periods) / 12 months

If you’re paid bi-weekly, monthly income = (average paycheck x 26 pay periods) / 12 months

If you’re paid bi-monthly, monthly income = average paycheck x 2

I work at a weekly paying job and the first time I tried figuring out my monthly income I just took my weekly paycheck and multiplied it by 4. I went by this for a little while in my budget and a few months in I realized that I was making more than I had initially thought. It’s a great feeling having more money than you think, but at the same time that money could’ve been invested and earned me some extra bucks. You win some and you lose some.

For example, let’s say that my weekly pay is $500. The way that I was calculating my income it would’ve resulted in $2,000 monthly. In reality, it was really:

($500 x 52) / 12 = $2,166.67.

An extra $166.67 every month! That’s an extra $2,000 every year! That could be saved up for a nice sunny vacation down south, maybe even two if you play your cards right.

After figuring out how much money you make, you might be thinking, the next logical step is to figure out how much you spend, right? Well, yes and no. David Chilton shares some earth-shattering news in The Wealthy Barber Returns – the most important thing is to pay yourself first.

How much money do you want to pay yourself?

The idea behind this is that you work hard for your money… and if you don’t then, at least pretend you do… and because you work so hard for your money, you should pay yourself before you pay any of your bills or expenses.

The concept of paying yourself first is simple: you pay yourself by saving money and putting it into investments or into a savings account where it earns interest. Why is this paying yourself? Simply put, the amount your investment grows or the interest you earn on your money is basically extra money you’ve earned for yourself, so it’s like you’re paying yourself. How do you know how much you need to pay yourself? As I mentioned in earlier regarding the 20/50/30 rule, you should pay yourself 20% of your monthly income.

“That makes no sense, how can I pay myself?”

“I need to pay for rent, my car, food, etc. before I can even THINK about saving”

WAIT! Trust me, it works and there’s an easy way to do it. Say my monthly after-tax income is the $2166.67 that we spoke about earlier and I’m getting paid $500 weekly. Instead of waiting until the end of the month to save with what’s left of my income, I make use of my money as soon as I get paid.

For example, on Friday I will get paid $500 into my chequing account. I open up a savings account with my local bank in order to start saving for retirement or a house. To pay myself first, I go into my bank’s app or go to my online banking and I set up an automatic transfer of $100 every Friday to be moved from my chequing account to my savings account or towards debt payments, which is 20% of my income for the record. This way, I know that I can only spend the $400 and not the usual $500. If you wait until the end of the month to start saving, you’ll find a lot of the time that you spend the money you should be saving on “one-time treats”.

The best way to save money for your savings, or paying off debt, is by far to just prevent yourself from having the opportunity to spend it. You can’t spend what you don’t have access to!

I know someone is reading this thinking “I’m an exception to this rule, I don’t have enough money to be doing this. All of my money goes to my necessities like rent, food, and transit.”. Well, maybe you’re right. Maybe instead of starting with 20%, you start with 5%. No, it’s not ideal to save 5% your whole life, but the best thing you can do is to start saving no matter what the amount is.

Alternatively, this could also be an opportunity to take a look at your fixed expenses and think about what you might be overspending on. You make $2166.67 a month and spend $1,500 a month on rent? Maybe it’s time to find a less expensive place to rent instead. BUT that’s a discussion for another time.

Determine how much you spend on necessities.

There aren’t a lot of things that I would qualify as necessities. Rent. Utilities. Food. Transportation to work. Necessities are… you know, necessary to live. Don’t you go counting your Netflix account in this section, as much as you might protest that it’s a necessity and you would die without it, you won’t. If you were living by the bare bones, these expenses are what you would include as a necessity. And yes, we are in the 21st century, Wi-Fi is most definitely a necessity (or else how would I be writing this blog?).

If you’re unsure what you spend on your necessities each month, do a quick audit of your last 6 months. Fixed expenses like rent and utilities should stay the same month to month. Variable expenses like food and transportation will require a small amount of extra work to figure out. You need to figure out the average you’ve been paying per month for these and that’ll be as good of a number as you’ll get.

BUT WAIT, THERE’S MORE! Not only is it important to figure out what your past costs have been, but the easiest way to start saving more money is to cut down on the big expenses in your life.

Are you buying steaks and shrimp every time you do groceries? Time to stock up on the canned soup and start eating chicken instead to save some extra money for every trip to the grocery store. This doesn’t mean you can’t treat yourself from time to time, but you shouldn’t be treating yourself a few times a week, try once or twice a month for the crazy dinners.

Maybe instead of driving to work, you start taking the bus, or even better, start biking! I know that it’s not always possible, not everyone wants to bike in that -30 degree winter (I sure as hell don’t want to), but it could be something that you can do now and then to save a few dollars.

An important part of figuring out your necessities is to write them down and get a friend to review them. This way you’ll get to see in how much each of your necessities cost in writing and you’ll get a friend to look over them and see if there’s something in there that really isn’t a necessity.

If you’re having trouble figuring out how much you should be allocating to this part of the budget, don’t fret! There’s also a general rule of thumb for your fixed expenses! Maybe that last sentence doesn’t deserve an exclamation point, but I’m trying to get you pumped up.

According to the 20/50/30 rule of thumb, your necessities should make up 50% of your income. This isn’t always going to be the case, it could be more and it could be less. It’s really more what you’d call guidelines. (Pirates of the Caribbean anyone? No? Okay.).

Don’t panic if it’s higher than 50%, we’ll get to ways to adjust your budget for necessities a little further down.

Figure out how much you can spend on discretionary purchases.

This is everybody’s favourite part of the budget – the discretionary spending money a.k.a. my bar budget, sorry mom! Using our 20/50/30 rule, this would equal roughly 30% of your income. Every good budget needs to leave room for some fun money. No person can, or should, live like a hermit for their own sanity. You’re bound to be tempted to spend money on something you don’t need, whether this might be another dinner out with the friends, that new pair of Jordans, or the new best selling book that you’ve heard is really good. The fun money will give you some leeway.

Any spending that you do that isn’t a necessity goes in this part of the budget. Yes, that means Netflix, Spotify, and your XBOX Gold membership all go into this part of the budget. Let me repeat that in simpler terms. Netflix is not a necessity. Many of you have probably already closed this page and are cursing my name right now, but hear me out on this one. You can find streams for TV episodes and movies all over the internet. You can download music anywhere on the internet or find a lot of it on YouTube. Use that free version of Spotify. Take advantage of free trials at all the possible options. No matter what way you spin it, these are not necessities.

A good way to keep track of this part of your budget is to write every item down. If you’re finding that you have too many subscriptions that you don’t have enough money left over for any fun things with your friends, then you’ll be able to look over the list and see what’s a priority for you.

Just because you have money left for this part of your budget doesn’t mean that it should all be discretionary spending. For example, if 30% of your monthly income is $1,000, you don’t need to spend $1,000. Set aside part of the excess money and pay yourself with it. Pay down that student debt. Contribute to your Tax-Free Savings Account (TFSA). Just don’t spend extra money that you don’t need to. It’s probably okay if you treat yourself once a month if you’ve got some extra cash, just don’t feel like you should or need to spend all of the money you have leftover. Whenever you can, pay yourself with it.

A good way to conserve some of the extra cash in this part of the budget is to save it for something fun. Maybe instead of spending all $1,000 each month, you spend $300 and put $700 towards a vacation fund. Or even better, split it three ways between spending, a vacation fund, and your savings.

If you think you’ve got some extra money left for personal purchases that you don’t need to spend, just do a quick check of your last few months of expenses. How much do you typically spend on personal items and outings each month? How can you cut that down? Are your sacrifices you plan on making reasonable? Well, only you will know. It’s not like once you plan a budget that it will be set in stone for the rest of time. You can evaluate if you’re setting enough for your personal purchases from month to month. You can save more if you find you’ve got some extra cash at the end of every month. It’s up to you.

That’s it! It’s fairly easy to get your budget going. To summarize the 20/50/30 rule we talked about throughout the article, 20% of your monthly income should go towards paying yourself first, 50% of your monthly income should go towards your necessities, and 30% of your monthly income should used for discretionary spending. Of course, this is just one way to make your budget. There are many ways you can create a more detailed budget, but the best way to start out is with a simple budget. It needs to be one that is easy to make, easy to understand, and easy to follow.

As you follow your budget month to month, you’ll be able to see if you can make any adjustments to it. Are your necessities making up only 40% of your monthly income? Pay yourself with that extra 10%. Are you having trouble meeting your payments for your necessities? Cut down on your discretionary spending to make sure you can pay your rent. You can change your budget month to month if you find that it’s not perfectly suited to you because as I mentioned earlier, the 20/50/30 rule if more of a guideline.

Let me know in the comments if you have any suggestions or comments on this budget. It’s by no means perfect, but it’s a good starting point.

Thanks for reading, eh!

Share this: